What would happen if the money you worked hard to save didn’t feel safe anymore? When markets change, and the economy shifts, many people start to wonder how long their savings will last or whether their plans will truly support the future they’ve imagined.

That’s where Thomas B. Hamlin comes in. As theFounder and CEO of the Somerset Family of Companies (Somerset Wealth Strategies, Somerset Wealth Management, and Somerset Securities), he has dedicated more than 35 years to helping people protect, grow, and preserve their wealth with confidence. Recognized as one of America’s leading voices in annuities, income planning, retirement planning, and wealth management, Hamlin’s expertise extends across all 50 states and three U.S. territories. Over the years, he has personally placed more than $1 billion in assets for nearly 5,000 clients nationwide, while his firms collectively manage billions more and have been featured in The Wall Street Journal, Barron’s, Worth, and Registered Rep.

Behind this success lies a deeper story—one defined by bold decisions, unwavering values, and a vision to make financial and retirement planning more personal, transparent, and dependable.

As Thomas Hamlin puts it, “We’re redefining wealth management by blending innovation with integrity—and ensuring that technology amplifies trust, not replaces it.”

From Salesman to Founder

Thomas Hamlin began his career in 1990 with Independent Advantage Financial in Los Angeles, a firm that marketed annuities nationwide through newsletters long before the digital era. Within a year, he became the company’s top salesman despite having no prior industry experience. Realizing there was no path for ownership or partnership, he set out to build something of his own—rooted in independence, integrity, and doing what’s right for clients.

In 1994, he and his mentor Jeff Oster joined Prudential Securities, where early challenges taught him a lasting lesson: never enter an agreement where clients lack the freedom to choose who they work with. Three years later, he founded Somerset Wealth Strategies under Raymond James Financial Services, naming it after the English county where his father was born.

By 2012, Thomas Hamlin acquired Bay Colony Securities of Boston, a 50-year-old broker-dealer, renaming it Somerset Securities and at the time launched Somerset Wealth Management, the firm’s fee-based fiduciary division. Today, more than three decades later, Somerset stands as a trusted name in wealth management—built on transparency, independence, and lasting client trust.

The Risk Taker’s Path

The financial services industry is one of the most tightly regulated fields, where challenges never stop coming. From managing expenses and supporting the team to staying compliant under constant scrutiny, every step requires resilience and focus. It’s an environment that tests one’s skills, patience, and perseverance.

Thomas Hamlin often reflects on a quote by Ray Kroc, the man behind McDonald’s: “Blessed are the risk takers, for without them, nothing would ever be done.” Those words capture much of his journey. Looking back, he admits that if he had known how demanding the road ahead would be, he might have paused before starting—but his belief in doing what’s right for clients, paired with sheer determination, kept him going. It was that steady persistence that turned early struggles into lasting success.

True Growth Comes from Staying True to Purpose

The first major turning point for Somerset came in 2000, when Thomas Hamlin moved to Lake Oswego, Oregon, and began expanding his team. What started as a small, determined group soon grew into a strong network of professionals—10 to 20 team members in Portland and marketing partners across Florida, Ohio, and Kansas. This period marked a phase of expansion and a deeper realization for Hamlin: true growth isn’t just about getting bigger—it’s about staying aligned with purpose. He learned that every step forward should strengthen what matters most, not pull you away from the passion that started it all.

Empowering Financial Education Through AnnuityFYI

In 2000, while Somerset was gaining momentum, Hamlin identified a critical gap in the financial services landscape. Ordinary Americans lacked access to unbiased, trustworthy information about annuities. Determined to bridge that gap, he founded AnnuityFYI, one of the nation’s first independent online resources dedicated to retirement income education.

At a time when reliable annuity guidance could only be found in high-cost newsletters or exclusive advisor circles, AnnuityFYI broke new ground by making clear, objective insights accessible to everyone. Hamlin’s vision was simple yet revolutionary:

“Everyone deserves access to clear, trustworthy retirement guidance. When people understand their options, they gain freedom, and that’s the foundation of peace of mind,” he adds.

Now celebrating its 25th anniversary, AnnuityFYI has guided thousands of individuals and families across all 50 states, empowering them to make informed retirement decisions with confidence. The platform remains proudly independent, offering no proprietary products, ensuring that every recommendation serves the client’s best interests.

Today, AnnuityFYI stands as a testament to Thomas Hamlin’s long-standing commitment to education, transparency, and client empowerment. Through its website, free tools, and the “Conquering Retirement with AnnuityFYI” podcast, the company continues to teach first, advise second, and inspire financial confidence for the next generation of retirees.

Steady Growth, Strong Values

Somerset’s operations have evolved alongside the financial industry’s growth. Built on a strong foundation in annuities valued for reliability and steady returns, the company has expanded into fee-based wealth management, insurance solutions, and select alternative investments.

Today, Somerset earns seven figures in annual recurring revenue, aiming to reach eight within five years.

Key growth milestones:

- $100 million in annual annuity business

- $50 million annually in new wealth management assets expected by 2026

- Transparent, client-focused strategies driving post-pandemic growth

A Philosophy Deeply Rooted In People and Purpose

Thomas Hamlin’s leadership philosophy is deeply rooted in people and purpose. He believes that success begins with building a team of driven, self-motivated individuals who share a passion for excellence and a genuine commitment to clients. Even as Somerset’s top producer—responsible for more than two-thirds of the company’s revenue—Hamlin emphasizes trust and empowerment within his leadership team, encouraging them to make independent decisions and lead with confidence.

This philosophy has fostered remarkable loyalty within Somerset. Many of Hamlin’s core team members have been with him for over a decade—Andrew Murdoch for 22 years, Derek Stamos for 14, Meg Odermatt for 12.5, Kristen Odermatt for 12, and Meagan Sinniger for 10.5. To Hamlin, such dedication reflects a culture built on mentorship, mutual respect, and shared purpose rather than hierarchy. His son, Brian, also joined the firm 3 years ago, carrying forward the same values and vision that continue to shape Somerset’s lasting legacy.

Hamlin’s Formula for Lasting Success in Finance

Hamlin explains that balancing innovation with stability begins with humility and experience. Having witnessed every major market cycle since 1987, he understands that long-term success in finance depends on adapting to change without losing sight of foundational principles. Under his leadership, Somerset has been built liken to a“Category 6 structure in an industry of Category 4 firms”—strong, resilient, and prepared to weather any storm.

He views failure as a natural and necessary part of progress. Guided by the Champion’s Creed—“Success is measured not by how many times you fail, but by how many times you keep trying until you succeed”—Thomas Hamlin fosters a culture that values experimentation and persistence. Somerset embraces innovation, but with discipline: every idea is tested, refined, and allowed to prove its worth before any pivot is made. This careful balance keeps the company forward-thinking and firmly grounded in profitability and trust.

AI Into Every Layer Of Its Operations

Technology and AI have become essential pillars of Somerset’s growth and client experience. The firm recognizes that innovation is not just about keeping up—it’s about leading with purpose. Partnering with AI strategist Geoff Woods, author of The AI-Driven Leader, Somerset has integrated artificial intelligence into every layer of its operations.

From client onboarding and data analysis to communication, compliance, and service delivery, AI helps advisors and admin operate with greater precision, personalization, and efficiency. It allows Somerset to match the scale and sophistication of the nation’s largest firms while preserving the trusted, personal relationships that clients value most.

Ultimately, technology at Somerset isn’t about replacing people—it’s about empowering them. Each team member is equipped to do more, serve better, and deliver consistent value at every stage of the client journey.

Smart Approach to Financial Growth

Somerset approaches growth with clarity and simplicity, focusing on what truly benefits clients rather than adding complexity. Over the years, the firm has explored a range of products—from annuities and life insurance to mutual funds and alternatives—but experience taught Thomas Hamlin and his team the power of focus.

Client benefits of Somerset’s strategy:

- Balanced growth with reduced risk (increased Alpha with lower Beta)

- 10–20% downside protection through RILAs

- Returns comparable to the S&P 500 or NASDAQ 100

- Fixed MYGAs offering ~6% returns for 5–7 years

This hybrid model blends the strengths of a traditional fee-based management platform with annuity stability—helping clients grow securely while preserving peace of mind.

Structured Training, One-On-One Mentorship For Employees

Identifying and developing talent at Somerset begins with finding people who share the company’s values of integrity, dedication, and client-first service. Developing great talent takes time, consistency, and genuine investment in people. Somerset emphasizes structured training, one-on-one mentorship, and clear goal-setting to help employees grow with direction and purpose.

The company understands that high turnover is very costly—not just financially, but culturally—so it focuses on creating an environment where employees feel valued and supported. Once the right individuals are part of the team, they are encouraged to take initiative, lead with confidence, and take full ownership of their roles. Mentorship plays a central role in this process; it’s not seen as an added responsibility but as the foundation that sustains long-term growth, strengthens leadership, and ensures continuity across the organization.

Building Financial Certainty in an Uncertain World

The future of income planning, Thomas Hamlin says, is about bringing stability to an unpredictable world. He believes everyone deserves a steady income they can count on for life—something Social Security alone may not provide.

Annuities help fill this gap by offering guaranteed lifetime payments, giving people peace of mind through financial security and independence.

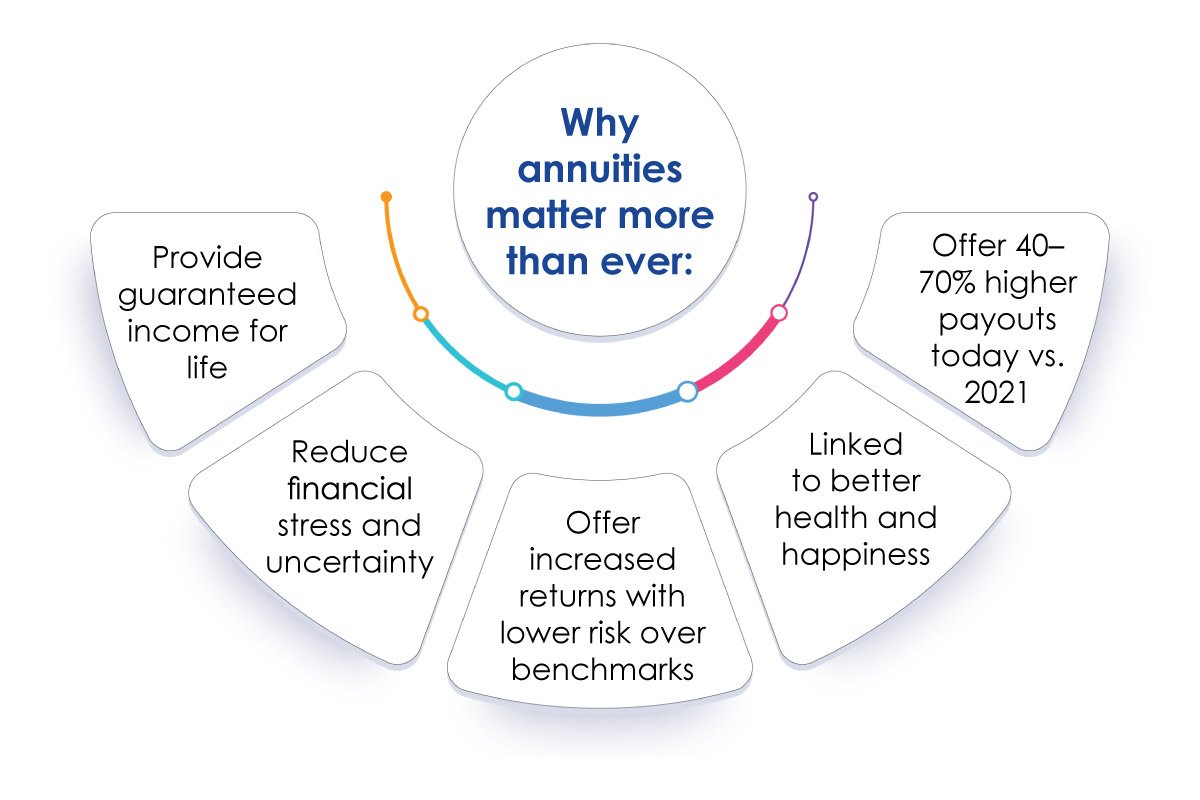

Why annuities matter more than ever:

- Provide guaranteed income for life

- Reduce financial stress and uncertainty

- Offer increased returns with lower risk over benchmarks

- Linked to better health and happiness

- Offer 40–70% higher payouts today vs. 2021

With today’s higher interest rates, Hamlin notes this is the best time in more than 30 years to secure a guaranteed income—and build long-term financial stability.

Financial Freedom Should Bring Peace Of Mind, Not Stress

Thomas Hamlin advises future clients and peers that true success isn’t measured only in numbers but in how people live and feel. His message is simple yet powerful: financial freedom should bring peace of mind, not stress. At Somerset, every plan is built around that promise. For Hamlin, innovation is never about chasing trends; it’s about creating lasting value and trust for every client who relies on them for their future.