Is the Future of Banking Inclusive, Digital, and Human?

Today, the fintech disruption is more than a buzzword, and the banking sector is being pushed to transform at a breakneck pace. With over 1.4 billion unbanked people globally, including millions in the Philippines, traditional banking models are no longer enough. The call to innovate isn’t just about keeping up with the times; it’s about survival, impact, and inclusion. According to the World Bank, improving access to financial services could lift millions out of poverty and drive economic growth. But how do you bridge this gap effectively and ethically?

Meet the man doing just that.

Lito Villanueva isn’t just navigating digital transformation—he’s defining it. A multi-awarded fintech pioneer and a fierce advocate for inclusive digital finance, Lito is reshaping how banking serves people, not just profits. Through his leadership, RCBC has become the Philippines’ most awarded bank for digital solutions and a benchmark for innovation across Asia. However, his mission goes far beyond awards—it’s about changing lives, one transaction at a time.

A Journey Rooted in Purpose

With over two decades of experience spanning banking, telecom, fintech, and policy advisory, Lito is no stranger to transformation. “When I stepped into RCBC six years ago, my goal was simple yet powerful—to make digital finance accessible to every Filipino, whether at home or abroad,” he shares.

That purpose translated into action quickly. Under Lito’s direction, RCBC launched a series of groundbreaking platforms, including RCBC Pulz, RCBC DiskarTech, RCBC ATM Go, and the AI-powered credit scoring engine, Pasado. But for him, technology is just a tool. “Innovation must come with empathy. We aren’t just building apps; we’re changing mindsets.”

From Ninth to Fifth: A Digital Leap

What sets RCBC apart is not just its technology but its results. In just three years, the bank catapulted from the ninth to the fifth-largest private universal bank in the Philippines in terms of assets. It also earned over 400 regional and global awards, including “Philippines’ Best Bank for Digital” for five consecutive years from Asiamoney and Euromoney.

“We went from serving 5% of towns and cities with our ATM Go network to reaching 100% of provinces and cities, and 94% of municipalities,” Lito reveals. This impressive expansion of handheld digital banking devices is a testament to what he calls “phygital” innovation—a hybrid of physical and digital infrastructure that brings banking closer to remote communities.

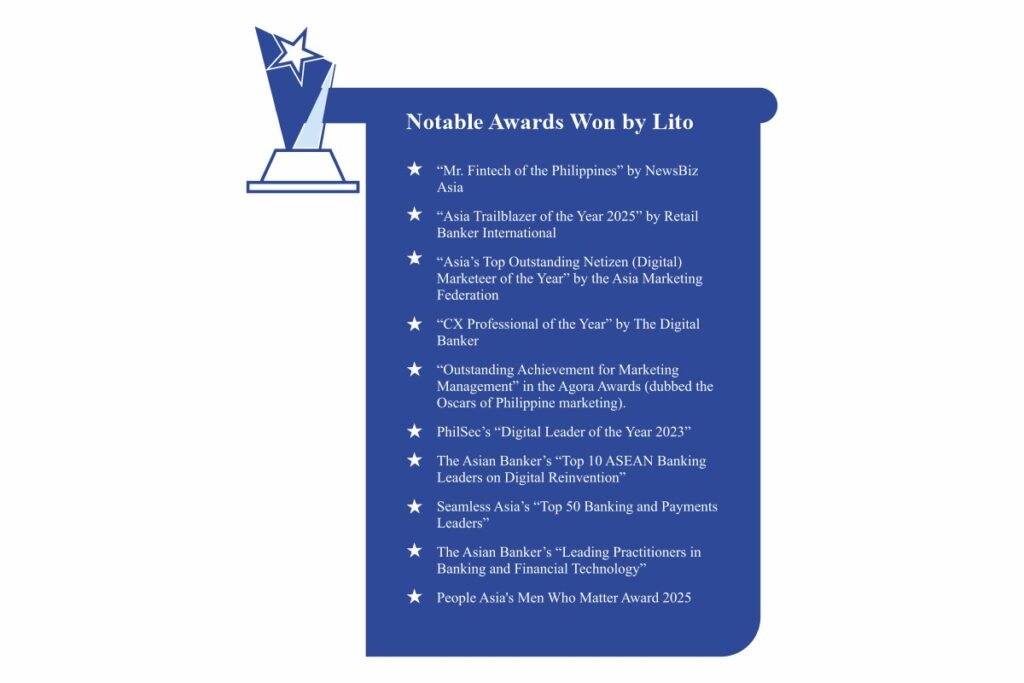

Notable Awards Won by Lito Villanueva

- “Mr. Fintech of the Philippines” by NewsBiz Asia

- “Asia Trailblazer of the Year 2025” by Retail Banker International

- “Asia’s Top Outstanding Netizen (Digital) Marketeer of the Year” by the Asia Marketing Federation

- “CX Professional of the Year” by The Digital Banker

- “Outstanding Achievement for Marketing Management” in the Agora Awards (dubbed the Oscars of Philippine marketing).

- PhilSec’s “Digital Leader of the Year 2023”

- The Asian Banker’s “Top 10 ASEAN Banking Leaders on Digital Reinvention”

- Seamless Asia’s “Top 50 Banking and Payments Leaders”

- The Asian Banker’s “Leading Practitioners in Banking and Financial Technology”

- People Asia’s Men Who Matter Award 2025

Culture by Design: Innovation with Heart

RCBC’s transformation didn’t happen in a vacuum. It was the result of a cultural shift, a rethinking of what banking should feel like.

“We transformed the company’s mission, vision, and values. Our new core values are built around the acronym C-L-I-E-N-T: Client Obsession, Loyalty, Integrity, Empowerment, Nurturing, and Teamwork,” explains Lito Villanueva.

He adds that RCBC isn’t merely digitizing services but revolutionizing the entire customer experience. From onboarding to servicing, every step is designed to be intuitive, secure, and impactful.

Breaking Barriers: From Islands to Inclusion

The Philippines is an archipelago with over 7,641 islands. Connectivity, both physical and digital, is a huge challenge. Yet RCBC has found ways to overcome this.

By partnering with Starlink and offering multi-sim connectivity through Globe and Smart, RCBC ensures even the most geographically isolated areas can access its services. A quarter of over 4,000-strong RCBC ATM Go agents currently operate in these far-flung regions using satellite internet.

Moreover, these agents are not just staff—they are local microentrepreneurs empowered to deliver financial services and uplift their communities.

Empowering Through Education and Collaboration

Financial literacy is central to Lito’s vision. RCBC has collaborated with agencies like the Department of Education, the Department of Trade and Industry, the Bangko Sentral ng Pilipinas, the Department of Migrant Workers, and the Commission on Filipinos Overseas to offer customized financial literacy programs.

“We even created digital finance modules for Grade 11 and 12 students and encouraged microenterprise proposals through our ‘DiskarTechPreneur’ initiative. It’s about building an entrepreneurial spirit early,” he shares.

For Overseas Filipino Workers (OFWs), RCBC rolled out programs teaching how to invest and start businesses back home.

“Reintegration is critical. We’re preparing them not just to return, but to thrive,” says Lito Villanueva.

Cybersecurity and Trust in the Age of AI

In an era of increasing digital threats, Lito emphasizes the role of trust and education. RCBC invests heavily in cybersecurity while advocating for a national fraud bureau that promotes interbank collaboration on cyber threat intelligence.

“AI is powerful, but we must use it responsibly. We push for enabling regulations—principle-based, not rule-based—so that innovation is not stifled,” he notes.

The bank’s AI initiatives go beyond automation. RCBC is exploring AI to enhance risk modeling, product personalization, and fraud detection, always with ethical safeguards.

Measuring Impact, Not Just Growth

“Digital is not a magic wand,” Lito insists. “The tech is just an enabler. The real transformation lies in people.”

RCBC’s inclusive innovations have resulted in:

- Over 400 local and global awards.

- Triple-digit growth across multiple performance metrics.

- Tangible economic impact in underserved communities.

These numbers validate a strategy that is as much about purpose as it is about profit.

Lito’s Message to the Next Generation

To all aspiring banking professionals and changemakers: have a crystal-clear purpose. Let your passion guide your innovation. Banking is not just about numbers; it’s about creating change. Make your mission bigger than yourself.

My goal has always been to uplift Filipino lives—whether through sustainable livelihood opportunities, digital access, or financial literacy. If you want to lead in this space, remember: the impact you create is the legacy you leave. Always pursue business with empathy, passion, and purpose.

What’s Next: The Road to 2025 and Beyond

As the financial world braces for an AI-powered revolution, RCBC is poised to lead. The bank is preparing for an influx of Gen Z and Gen Alpha customers by focusing on hyper-personalization, embedded finance, and sustainable innovation.

“We don’t aim for a cashless society, but a cash-lite one where access and choice coexist,” says Lito Villanueva.

RCBC is also gearing up for regional expansion and deeper public-private collaboration. Its partnership-based model is becoming a case study in balancing innovation with inclusion.

Redefining Banking, One Filipino at a Time

Lito Villanueva’s leadership proves that transformation doesn’t require abandoning tradition—it means reimagining it. From his daily interactions in local markets to his digital strategies in boardrooms, he remains grounded, approachable, and purpose-driven.

“I want to be remembered as someone who created real impact, who embedded empathy in innovation, and who never lost sight of the people behind the technology,” he says.

In an industry often dominated by cold numbers and bottom lines, Lito Villanueva reminds us that the heart of banking is, and always should be, the human experience.