Source – Data Center Knowledge

Dell, the multinational technology company based in Round Rock, Texas, projected a lower-than-expected profit for the current quarter, citing increased costs associated with building servers optimized for heavy artificial intelligence (AI) workloads. The announcement caused a significant drop in Dell’s shares, declining more than 17% in after-hours trading.

Margin Pressure and Profit Outlook

Dell anticipates its adjusted gross margin rate to decrease by approximately 150 basis points in fiscal 2025. The company expects adjusted profit per share for the current quarter to be around $1.65, with a margin of error of plus or minus 10 cents. This forecast falls short of analysts’ average estimate of $1.84, as per data from LSEG.

Yvonne McGill, Chief Financial Officer of Dell, attributed the margin decline to inflationary input costs, intensifying competition, and a higher proportion of AI-optimized servers in their product mix. These factors collectively contribute to the anticipated erosion in the gross margin rate.

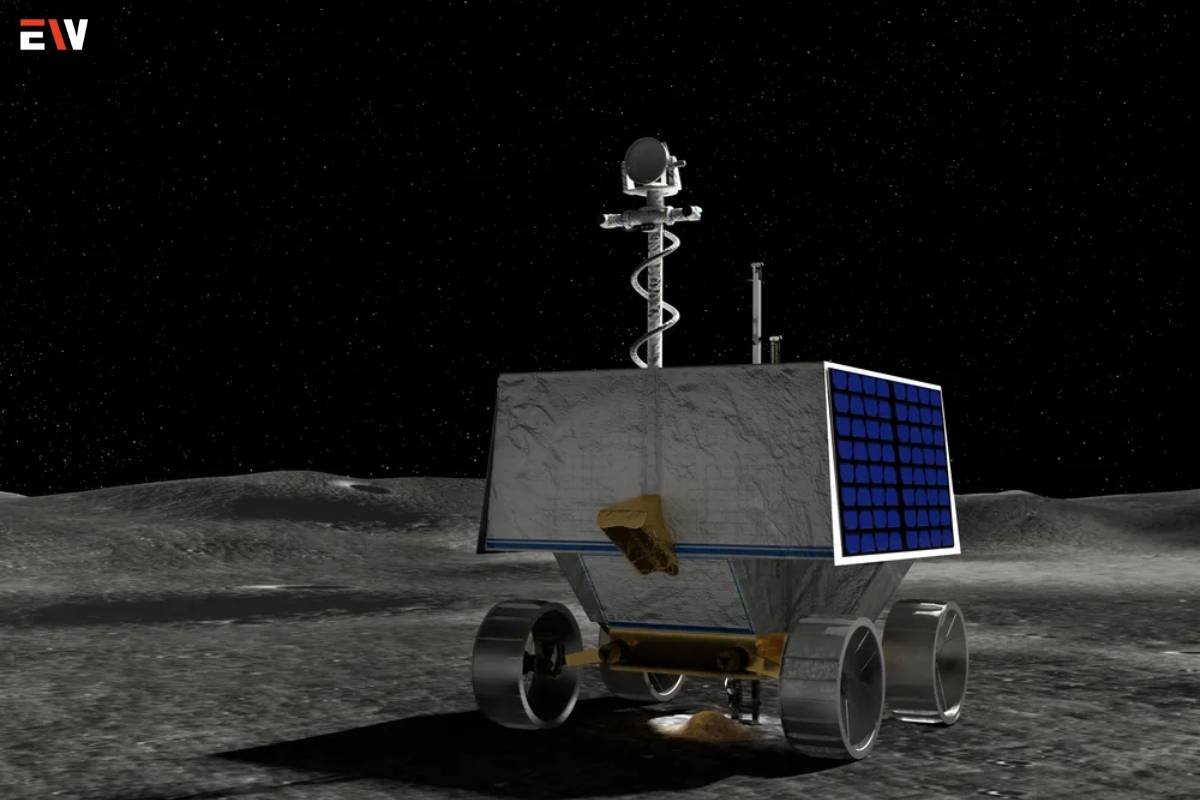

Growing Demand for AI Servers

The surge in demand for high-performance computing and expansive data centers, driven by the increasing adoption of generative AI technologies, has fueled investments in AI-capable products. Dell, among other companies, has witnessed heightened demand for its servers tailored for AI workloads.

Mikako Kitagawa, Director Analyst at Gartner, noted that Dell’s margin decline reflects the competitive pricing landscape, as the market continues to recover and competitors vie for market share.

Positive Revenue Outlook

Despite the margin challenges, Dell reported promising figures in terms of revenue. Shipments of the company’s AI-optimized servers more than doubled, reaching $1.7 billion, while the backlog increased by over 30% to $3.8 billion, according to Jeff Clarke, Chief Operating Officer of Dell.

The company also unveiled a range of AI-enabled PCs powered by Qualcomm processors and announced the upcoming availability of a new server supporting Nvidia’s latest chips in the second half of 2024. These strategic moves align with Dell’s efforts to capitalize on the growing demand for AI-driven solutions.

Financial Projections and Market Response

Dell’s stock has experienced substantial growth, more than doubling in value this year and reaching a record high recently. For the second quarter, the company forecasts revenue between $23.5 billion and $24.5 billion, surpassing the average analyst estimate of $23.21 billion.

Additionally, Dell raised its revenue forecast for fiscal 2025 to a range of $93.5 billion to $97.5 billion, compared to the previous projection of $91 billion to $95 billion. Despite the lower profit outlook, its revenue growth outlook indicates a positive trajectory.

In the first quarter ended May 3, they recorded a 6% increase in revenue, amounting to $22.24 billion, marking a break in the streak of six consecutive quarters of declines. The revenue growth was primarily driven by a 22% rise in the infrastructure solutions group’s revenue, offsetting the flat revenue in the client solutions group, which encompasses PCs. Adjusted profit for the quarter was largely in line with analysts’ expectations.