Source- Bloomberg

Inflation Outlook Adjusted

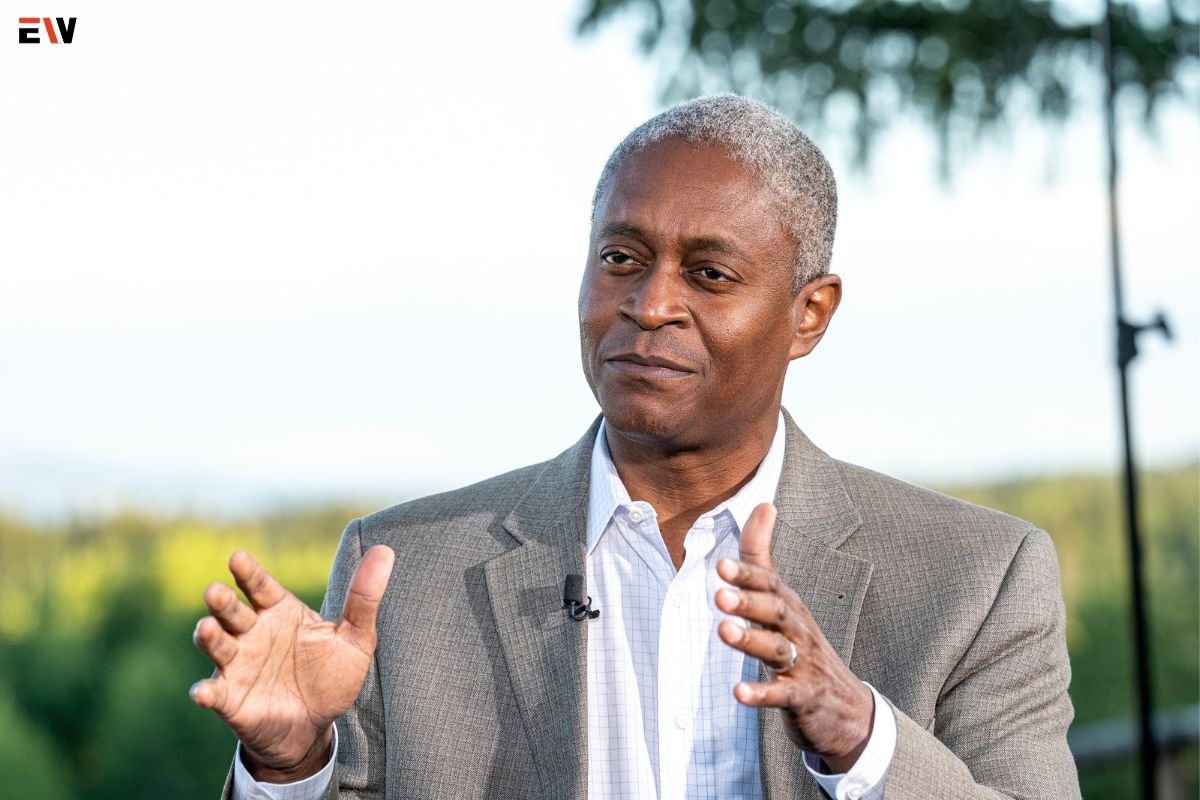

Atlanta Federal Reserve President Raphael Bostic addressed concerns about inflation during a speech on Thursday, indicating that the return to the central bank’s 2% target would be more gradual than previously anticipated. Bostic expressed comfort with this pace, citing the ongoing job creation and wage growth in the economy.

Patient Approach to Monetary Policy

Speaking at an event hosted by the Greater Fort Lauderdale Alliance in Florida, Bostic emphasized his willingness to exercise patience regarding monetary policy adjustments. He noted that the current economic conditions suggest a slower trajectory this year, implying that rate reductions may not be warranted until the end of the year.

A shift in Rate Cut Expectations

The Atlanta Federal Reserve President has maintained its policy rate within the range of 5.25% to 5.50% since July of the previous year. Initially, policymakers anticipated multiple rate cuts by the end of 2024 due to a perceived rapid decline in inflation. However, recent inflation data surpassing expectations has led to a reassessment of these projections.

Bostic has been instrumental in advocating for this shift, projecting only one rate cut in the fourth quarter and even suggesting the possibility of no rate cuts at all in the current year.

Labor Market Focus and Policy Stance

Bostic underscored the importance of monitoring labor market dynamics, particularly job creation and wage growth, to gauge the health of the economy. He expressed willingness to maintain the current policy rate if these indicators remain positive and inflation shows signs of gradually approaching the Fed’s target.

According to Bostic, the current monetary policy stance is restrictive and is expected to moderate economic growth while guiding inflation toward the 2% target over the next couple of years.

Bostic’s remarks reflect a cautious approach by the Atlanta Federal Reserve President as it navigates the complex dynamics of inflation, employment, and economic growth. The Fed’s evolving stance underscores the need for a nuanced and data-driven approach to monetary policy in the face of evolving economic conditions.