Source – Reuters

Sustained Growth Amid Global Challenges

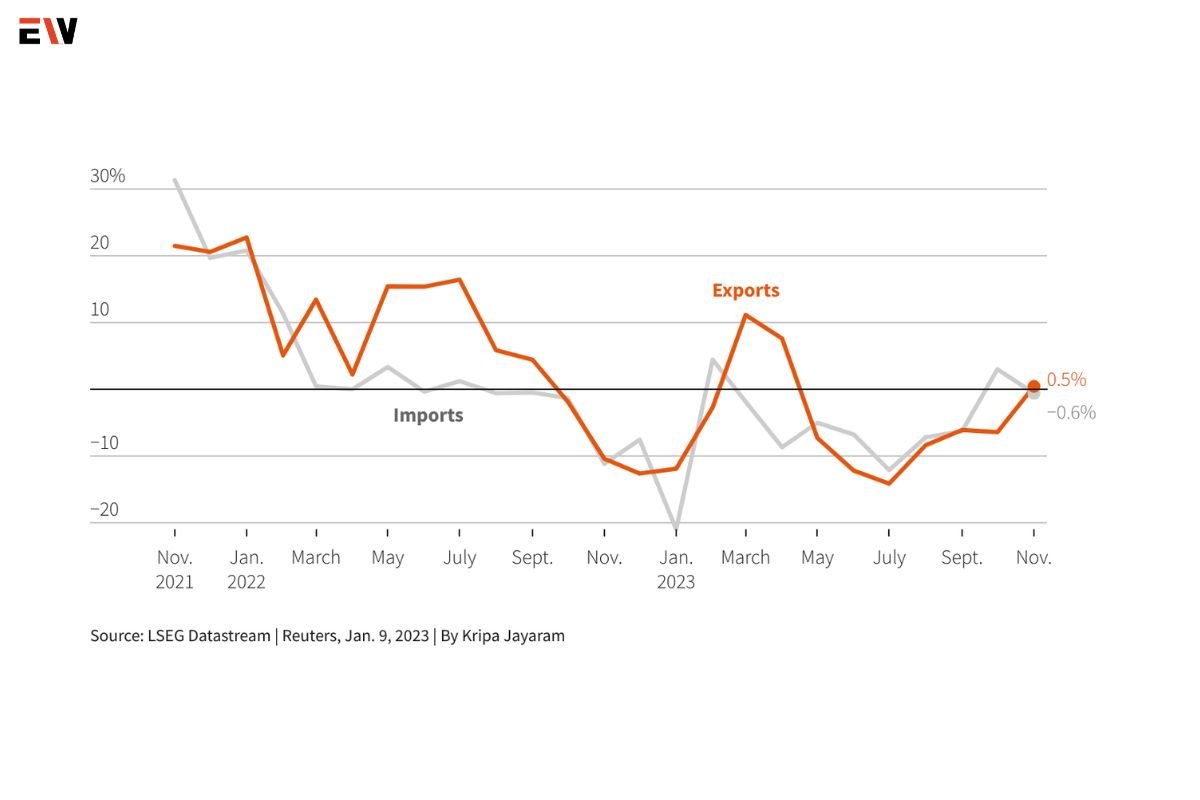

China’s export sector demonstrated impressive growth for the second consecutive month in May, suggesting that Chinese manufacturers are successfully finding overseas buyers despite ongoing economic challenges. This export resilience offers some respite to the nation’s economy as it strives for a sustainable recovery. However, the longevity of this export momentum remains uncertain due to a prolonged property crisis that has significantly weakened domestic demand, a trend highlighted by last month’s import data.

Strong Export Performance

Bruce Pang, the chief China economist at Jones Lang LaSalle, noted that the robust year-to-date growth in China’s exports in May is largely due to the country’s significant global market share, favorable yuan exchange rates, and exporters accelerating shipments ahead of anticipated tariff hikes in key export markets.

According to customs data released on Friday, outbound shipments from the world’s second-largest economy grew by 7.6% year-on-year in May. This surpassed the forecasted 6.0% increase and a modest 1.5% rise observed in April. The growth was also likely boosted by a lower base of comparison from the previous year when rising interest rates and inflation in the U.S. and Europe dampened external demand.

Domestic Demand Concerns

Despite the positive export figures, domestic demand continues to show signs of fragility. Imports increased by only 1.8% in May, down from an 8.4% jump the previous month, underscoring the weakness in domestic consumption. Recent data has painted a mixed picture of the $18.6 trillion economy’s recovery, with various sectors rebounding at different paces. While the first quarter saw stronger-than-expected growth and promising export and output data in March, more recent indicators suggest that soft domestic consumption is dampening earlier optimism.

Economic Policy and Outlook

May’s commodity import data further highlighted the mixed domestic demand, with year-on-year declines in crude oil and soybean purchases, while copper and iron ore imports saw increases. The ongoing property sector crisis remains a significant drag on China’s economy, affecting investor and consumer confidence and hampering business activity. Nonetheless, the latest trade data offers some relief to policymakers as they work towards fostering a broad-based economic recovery. Analysts anticipate additional policy support measures from China in the near term, with a government pledge to boost fiscal stimulus expected to help bolster domestic demand.

The International Monetary Fund (IMF) recently raised its growth forecast for China to align with Beijing’s target of around 5% for 2024 but cautioned about potential risks from the property sector issues. Meanwhile, China’s stock market saw declines as positive export numbers were overshadowed by news of U.S. lawmakers pushing to ban Chinese battery firms with ties to major automakers like Ford and Volkswagen from exporting to the U.S.

Hi-Tech Sector Boost

The electronics sector played a notable role in China’s export growth, with integrated circuits exports rising by 28.4% year-on-year in May. This surge aligns with strong chip shipments from South Korea, indicating a potential global upturn in the electronics market. Despite Western criticism of China’s industrial overcapacity in advanced and green sectors, Beijing has refuted such claims, accusing the U.S. and EU of trade protectionism.

China’s trade surplus grew to $82.62 billion in May, surpassing forecasts and the previous month’s figure. This surplus has been frequently highlighted by the U.S. as evidence of one-sided trade favoring China. Despite new U.S. tariffs on $18 billion worth of Chinese exports, including a significant increase in new energy vehicles, analysts believe China’s exports will remain robust, driven by a weaker exchange rate and exporters rushing to ship goods before tariffs take effect.