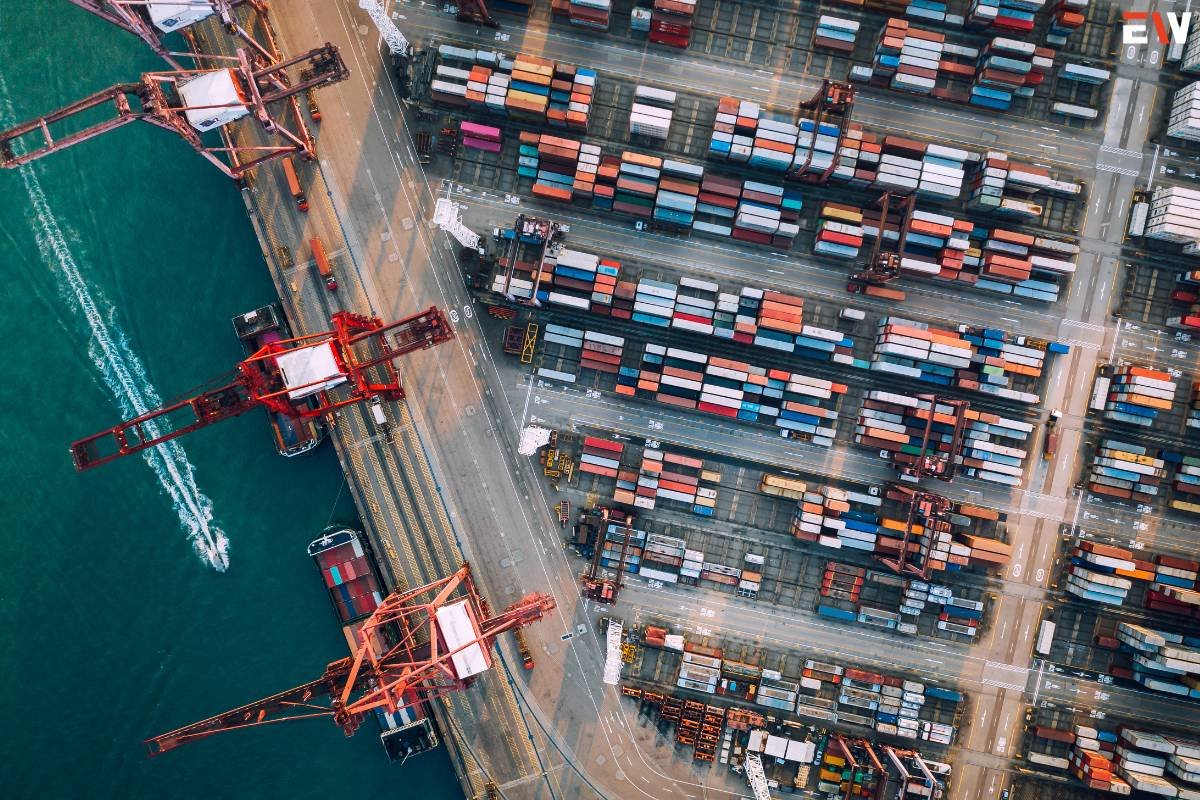

Resurgence in Exports

China’s export sector saw a glimmer of hope in November as exports rebounded after a six-month slump, hinting at increased attractiveness due to discounted pricing strategies adopted by factories in the country. The data signifies efforts to counter prolonged low demand by enticing buyers with competitive pricing.

Export and Import Statistics

According to customs data released on Thursday, November witnessed a 0.5% growth in exports compared to a 6.4% decline in October. This exceeded expectations, surpassing the anticipated 1.1% drop. Conversely, imports contracted by 0.6%, defying projections of a 3.3% increase and reversing the 3.0% upturn witnessed the previous month.

Analyst Perspectives

Economists like Zhiwei Zhang from Pinpoint Asset Management noted that the export improvement aligns with market predictions, highlighting sequential growth in China’s exports over the past months. Zhang also points out similar positive trends in Asian countries’ export data.

Global Trade Indicators

The Baltic Dry Index, a crucial measure of global trade, surged to a three-year peak in November, driven by increased demand for industrial commodities, particularly from China. Additionally, South Korean exports, indicative of global trade health, rose for the second consecutive month, fueled by chip exports after 15 months of decline.

China’s exports grow 0.5% in November compared to last year | World DNA

Challenges Persist

Despite these positive indicators, challenges persist for Chinese manufacturers. Export orders declined for a ninth consecutive month, reflecting ongoing struggles to attract overseas buyers. Price reductions by exporters have supported export volumes but raise concerns about sustainability.

Mixed Economic Signals

While hard data reflects better-than-expected growth in the third quarter, sentiment-based surveys and internal economic factors paint a more cautious picture. Analysts remain skeptical about the sustainability of recent policy support measures and their impact on domestic demand amid uncertainties in areas like property, unemployment, and weak business confidence.

Cautionary Outlook

Amid China’s export rebound, caution prevails regarding future sustainability. Factors like cooling European and U.S. economies pose challenges, prompting emphasis on bolstering domestic demand as the primary growth driver in 2024.

Market Response and Future Concerns

Market reactions mirrored this cautious sentiment, with the yuan depreciating against the dollar, and stock indexes in China and Hong Kong witnessing declines. Questions linger about whether the recent export momentum can be a long-term growth driver amidst uncertainties in global economies.

China’s economic landscape presents a mix of positive export trends and persistent domestic concerns, prompting a cautious outlook despite short-term improvements.