Alphabet Inc. (NASDAQ: GOOG, GOOGL; TSX: GOOG:CA) has established itself as a dominant player in artificial intelligence. Now, with Alphabet Quantum Supremacy emerging as a key milestone, the company is making significant strides in quantum computing—a technology that could represent the next major inflection point in computing power and capability.

Unlike smaller, speculative quantum computing companies, Alphabet offers a lower-risk entry point for investors seeking exposure to this emerging sector. With its track record of technical breakthroughs, robust financial resources, and diverse business ecosystem, Alphabet is positioned to maintain leadership in quantum innovation while offering the stability of a global technology giant.

Momentum in the Market

Alphabet’s shares are trading just above $200, near the 52-week high of $207.05. A breakout above that level could draw momentum investors, potentially pushing the stock to new record highs. For long-term investors, this combination of strong fundamentals and near-term technical strength presents a compelling entry point.

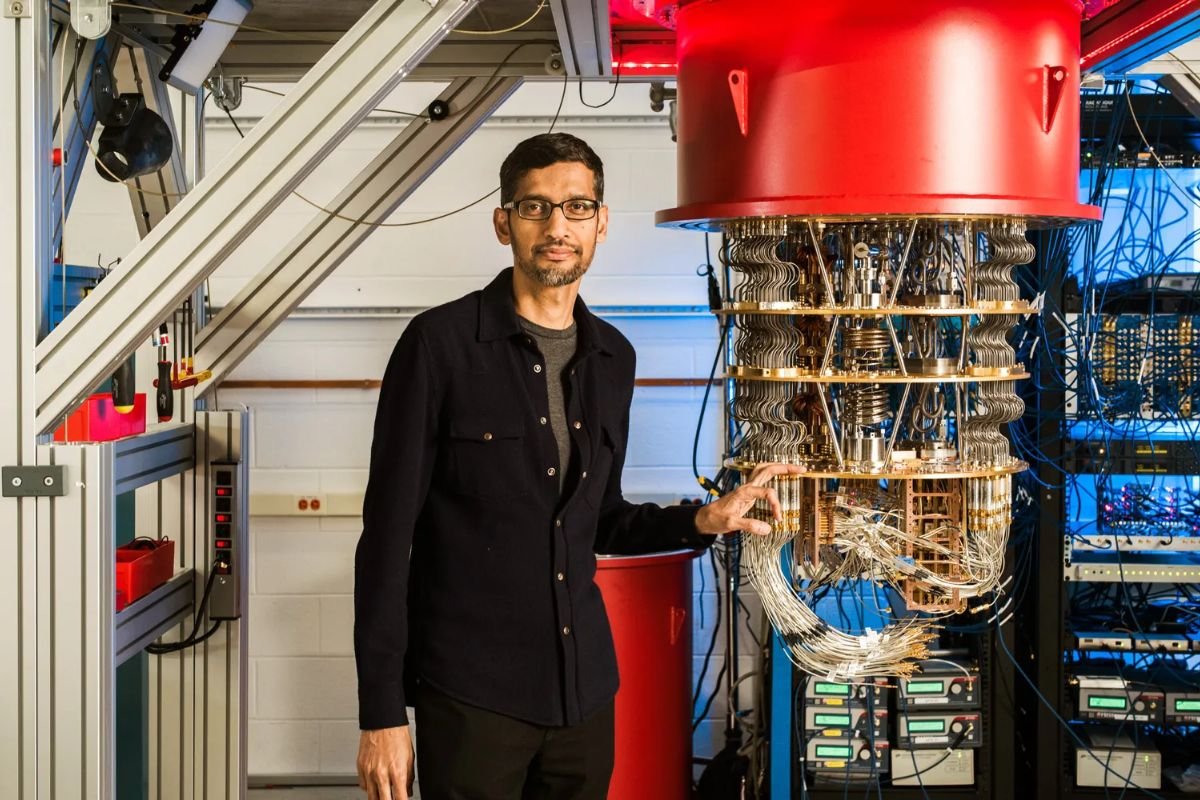

Breakthroughs in Quantum Supremacy

Alphabet’s push into quantum computing is not recent—it has been building for years. In 2019, the company’s Sycamore processor achieved what it called “quantum supremacy,” performing a calculation in 200 seconds that would take a conventional supercomputer an estimated 10,000 years.

In 2023, Alphabet advanced quantum error correction by creating a prototype logical qubit that reduced computational errors—a key step toward building scalable and reliable quantum computers.

The pace of progress accelerated again in 2024 with the introduction of the “Willow” chip. Willow maintained error reduction as the number of qubits scaled upward and executed a computation in under five minutes that would take a traditional supercomputer roughly 10 septillion years. This leap underscores Alphabet Quantum Supremacy and its unmatched technical capabilities in quantum computing.

Why Alphabet Has the Advantage

Several factors position Alphabet ahead of its competitors:

- Financial Strength – Alphabet’s substantial cash reserves and profitability mean it can fund quantum research without relying on external capital. Many smaller players in the sector operate at significant losses and may face funding challenges if capital markets tighten.

- R&D Scale – Alphabet’s research and development budget dwarfs that of smaller competitors. This scale allows for accelerated innovation cycles and a breadth of experimentation that most rivals cannot match.

- Integrated Ecosystem – The company can leverage assets like Google Cloud, AI, and its data infrastructure to accelerate quantum computing applications in fields such as pharmaceuticals, materials science, and energy.

This combination of resources and integration is a competitive advantage that smaller companies—focused solely on quantum hardware—cannot replicate.

The Competitive Landscape

Several publicly traded pure-play quantum computing firms exist, including IonQ (IONQ), D-Wave Quantum (QBTS), Rigetti Computing (RGTI), and Quantum Computing Inc. (QUBT). These companies have shown recent share price volatility, especially following the announcement of Alphabet Quantum Supremacy with its Willow chip, which drew significant investor attention to the sector.

However, these smaller firms face common challenges: limited revenue, lack of profitability, and dependence on capital raises to sustain operations. For example, IonQ reported quarterly losses exceeding $170 million despite a strong balance sheet bolstered by a recent $1 billion equity raise. Many of these companies will likely need to return to capital markets within the next two years.

By contrast, larger technology firms like IBM and Microsoft maintain quantum research divisions but have not matched Alphabet’s pace of breakthroughs. Alphabet’s advancements in both processing speed and error correction set it apart from these competitors.

Risks and Considerations

While Alphabet’s position appears strong, smaller companies could deliver unexpected breakthroughs that disrupt the competitive landscape. As pure plays, these firms could see significant share price appreciation if they achieve commercially viable quantum systems sooner than anticipated.

Additionally, the quantum computing industry is still in its early stages, and widespread commercial adoption remains years away. Regulatory shifts, intellectual property disputes, or unexpected technical challenges could delay progress.

Outlook

Alphabet has demonstrated consistent innovation in quantum computing, backed by industry-leading resources and a diversified technology portfolio. These strengths reduce the investment risk typically associated with cutting-edge, pre-commercial technologies.

For investors seeking exposure to the quantum computing revolution without taking on the extreme volatility of early-stage companies, Alphabet offers a balanced combination of growth potential and stability. With strong technical momentum, a healthy balance sheet, and a clear commitment to quantum research, Alphabet Quantum Supremacy appears poised to maintain—and potentially extend—the company’s lead in the race toward quantum dominance.

Visit Enterprise Wired for the most recent information.