Source – Quartz

The U.S. Securities and Exchange Commission (SEC) moved swiftly to dispel rumors of Bitcoin Exchange-Traded Funds (ETFs) approval, following a deceptive message posted on social media. A tweet from the compromised @SECGov X/Twitter account erroneously claimed that the SEC had greenlit Bitcoin ETFs, triggering a momentary surge in Bitcoin’s value before a sharp decline below $46,000.

Unauthorized Access Detected by SEC

An SEC spokesperson confirmed that their X account suffered unauthorized access by an unknown entity just after 4 p.m. ET. Emphasizing a commitment to cooperation with law enforcement, the SEC pledged a thorough investigation into the breach and any associated misconduct.

Amidst the tumult, the SEC is expected to make a decisive ruling on Bitcoin ETFs this week, marking a potential turning point after a history of resistance. A notable number of asset management firms, including those who updated registration statements on Tuesday morning, have fervently applied to establish such a fund.

Impact of Potential ETF Approval

Bitcoin’s recent surges have been partly fueled by hopes pinned on the approval of spot Bitcoin ETFs. Unlike existing funds tied to Bitcoin futures, these ETFs could attract a fresh cohort of investors, including cautious financial advisors, drawn by the relative simplicity of ETFs compared to Bitcoin custody complexities.

Spot Bitcoin ETF approval post by @SECGov was ‘unauthorized’

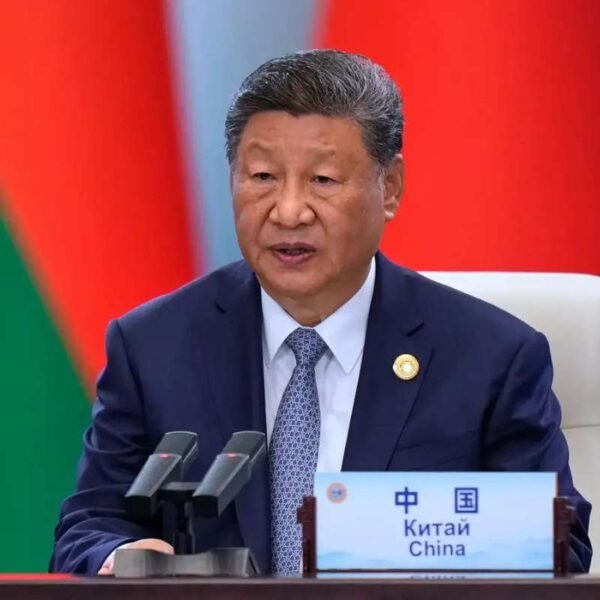

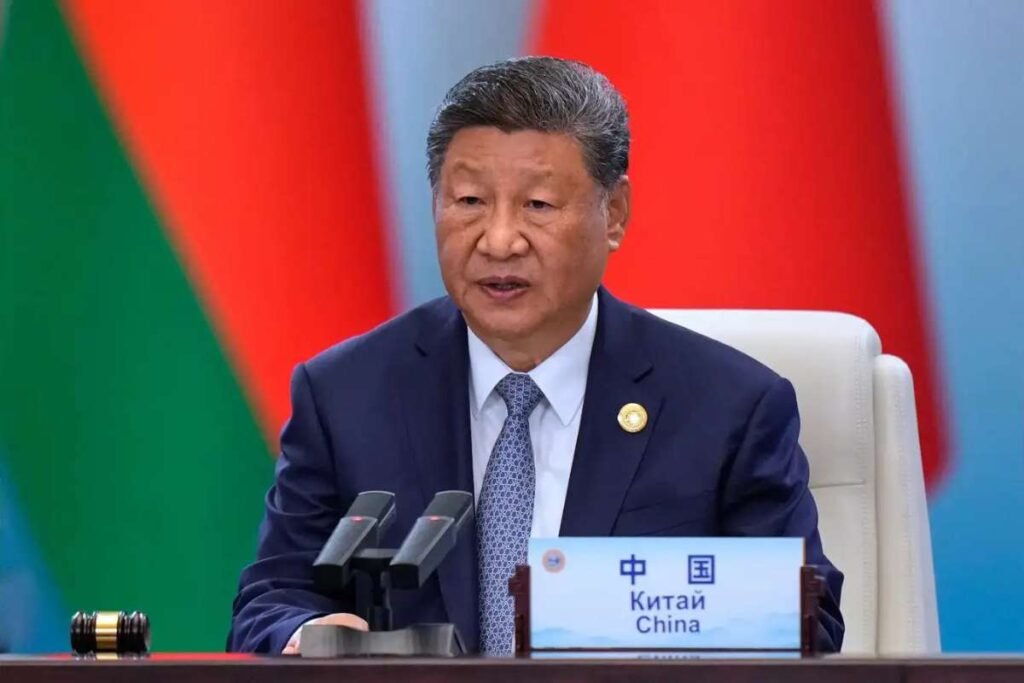

Gensler’s Stance and Regulatory Actions

SEC Chair Gary Gensler, renowned for his skepticism toward cryptocurrencies, has led the commission in robust actions against the crypto sphere. He previously cautioned investors about the risks entwined with crypto-related products via social media.

Past Legal Battles and Speculation

In a significant legal tussle last year, the SEC faced a setback against crypto asset manager Grayscale, which sought approval to convert a Bitcoin-held over-the-counter trust into an ETF. The SEC’s decision not to appeal this ruling has sparked speculation that the regulator might lean towards approving Bitcoin ETFs.

The potential approval of Bitcoin ETFs carries far-reaching implications for the crypto market, potentially unlocking access for a broader base of investors. However, amidst the chaos sowed by the false social media announcement, coupled with the SEC’s ongoing investigations, the fate of these ETFs remains shrouded in uncertainty, hinging on the SEC’s forthcoming decision. As the market eagerly awaits developments, the landscape of crypto investments teeters on the edge, influenced by regulatory decisions and market dynamics.