The United States and Taiwan agreement marks a major step in expanding semiconductor manufacturing capacity within the United States. Under this deal, Taiwanese chip and technology companies will invest at least 250 billion dollars in US‑based production, making it one of the largest cross‑border commitments in the global semiconductor industry. The United States and Taiwan agreement is designed to provide long‑term clarity for chipmakers while strengthening supply chain stability for businesses that rely on advanced computing hardware.

Investment Framework and Manufacturing Expansion

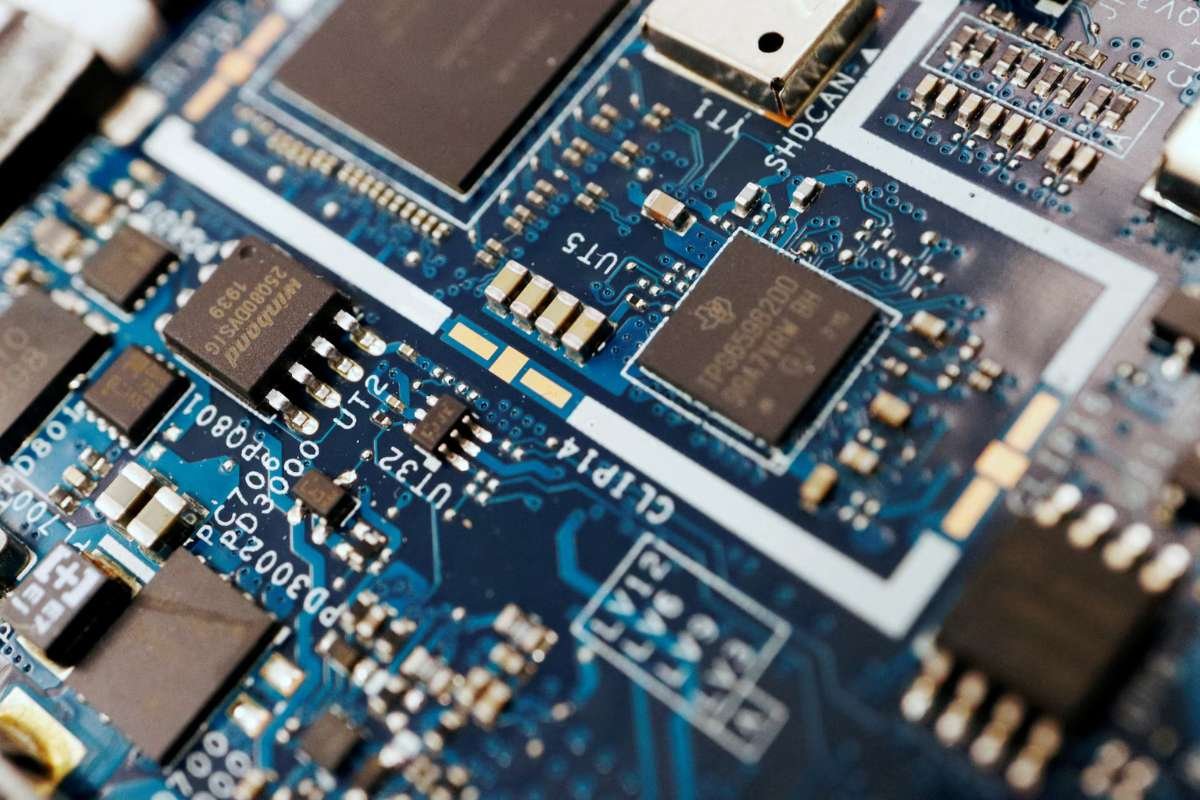

At the center of the United States and Taiwan agreement is a commitment by Taiwanese companies to build and expand chip production facilities on American soil. The investment will fund new fabrication plants, equipment purchases, and the supporting infrastructure required for advanced semiconductor manufacturing. In addition to private sector spending, the Taiwanese government will guarantee up to 250 billion dollars in credit to assist companies involved in the expansion.

The agreement includes provisions that allow companies building chip facilities in the United States to continue importing certain production capacity while construction is underway. During this period, firms can import up to two and a half times the amount of capacity they are building without facing additional tariffs. Once facilities are completed, companies will be able to import up to one and a half times their US production capacity.

This structure is intended to help manufacturers manage supply commitments while scaling operations. For businesses that rely on a steady flow of chips, the phased approach reduces disruption during construction and expansion cycles. It also encourages companies to move forward with large capital investments without facing immediate trade barriers.

Taiwan Semiconductor Manufacturing Company, one of the largest players in the sector, has already acquired land near its existing facilities in Arizona. The company has previously invested billions of dollars in US fabrication plants that supply chips to major technology firms. While future expansion plans remain subject to market demand, the agreement provides a clearer path for continued growth.

Trade Terms and Business Implications

As part of the deal, reciprocal tariffs on Taiwan will be capped at 15 percent, lower than previous levels. Certain categories, including generic pharmaceuticals, pharmaceutical ingredients, aircraft components, and selected natural resources, will not face reciprocal tariffs. Taiwanese auto parts and lumber products will also remain below the 15 percent threshold.

For semiconductor and technology companies, these terms reduce uncertainty around future trade costs. Over the past year, shifting tariff expectations have complicated long term planning for firms with global supply chains. The agreement offers clearer guidelines that can be factored into pricing, sourcing, and investment decisions.

The arrangement also outlines how future tariff frameworks will apply to companies that build manufacturing capacity in the United States. Firms that commit to domestic production receive more flexible import allowances during construction and ramp up phases. This approach aligns trade policy with operational realities in the semiconductor industry, where building and qualifying new facilities can take several years.

From a business perspective, the United States and Taiwan agreement reinforces the importance of geographic diversification in chip manufacturing. Concentration risk has become a major concern for technology companies, automakers, and cloud service providers. By expanding production in the United States, the United States and Taiwan agreement adds redundancy to global supply chains and reduces exposure to disruptions in any single region.

The scale of the investment is expected to generate long term opportunities for suppliers, construction firms, equipment manufacturers, and service providers that support chip fabrication. It may also influence related industries such as data centers, artificial intelligence development, and advanced manufacturing.

For entrepreneurs and business owners, the agreement signals sustained demand for semiconductor related products and services. Companies involved in materials, tooling, logistics, and workforce training are likely to see increased activity as new facilities move from planning to operation. As chip production capacity grows, downstream industries that depend on reliable access to advanced processors stand to benefit from improved supply stability and planning confidence.