Key Points:

- $6.6B Employee Share Sale boosts OpenAI’s valuation to $500B.

- Now Top Private Tech Firm, surpassing SpaceX.

- Expanding Globally with Microsoft, Oracle, Samsung, and SK Hynix.

OpenAI Valuation has surged to $500 billion after a secondary stock sale aimed at retaining employees. The artificial intelligence company behind ChatGPT could now become the world’s most valuable startup, surpassing SpaceX and ByteDance.

A group of current and former OpenAI employees sold $6.6 billion in shares to investors including Thrive Capital, Dragoneer Investment Group, T. Rowe Price, SoftBank, and the United Arab Emirates-based MGX, according to a source familiar with the transaction. The stock sale highlights growing investor confidence in the long-term potential of generative AI, even as the company has yet to turn a profit.

Strong investor demand amid AI growth

OpenAI Valuation underscores market optimism surrounding AI’s role in driving business transformation. Since its founding in 2015 as a nonprofit research lab, OpenAI has evolved into one of the leading developers of AI systems, widely known for its ChatGPT product. The company’s rapid growth has drawn interest from global investors seeking exposure to advanced AI capabilities across sectors including retail, cloud computing, and media.

The stock sale comes at a time when competition for AI talent is intensifying. Major technology companies, such as Meta Platforms, have been aggressively recruiting top AI engineers while committing billions of dollars to AI-focused ventures. For OpenAI, the sale provides a mechanism to reward employees and maintain competitiveness with publicly traded rivals that can offer stock-based incentives.

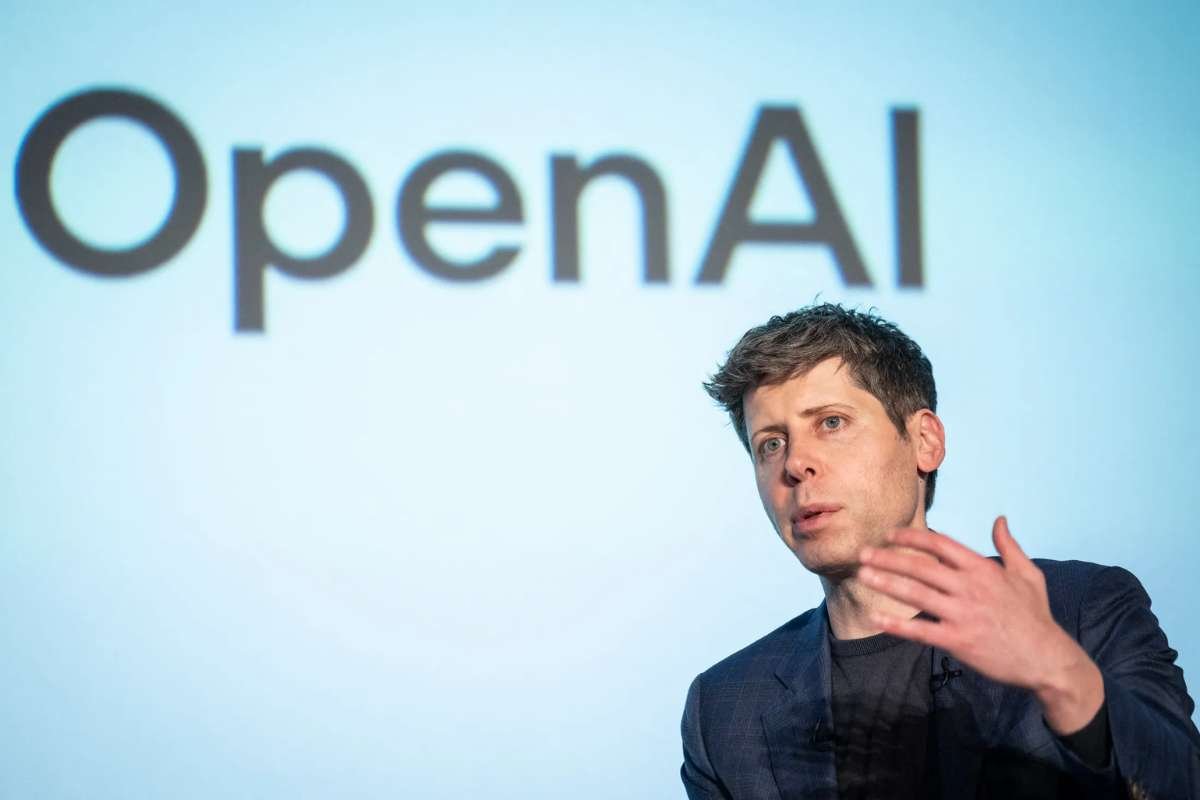

CEO Sam Altman recently acknowledged the risks and volatility that come with rapid growth in emerging technologies but emphasized the long-term opportunities. “Between the ten years we’ve already been operating and the many decades ahead of us, there will be booms and busts,” he said during a visit to the company’s new data center project in Abilene, Texas. Altman added that while missteps and capital allocation challenges are inevitable, the broader trajectory of AI will drive “a new wave of unprecedented economic growth.”

Expanding ventures and partnerships

OpenAI Valuation continues to rise as the company diversifies its business portfolio through new partnerships and product launches. This week, the company introduced two ventures: a collaboration with Etsy and Shopify to enhance online shopping through ChatGPT, and a new social media app, Sora, designed for creating and sharing AI-generated videos.

The company has also been building large-scale infrastructure to support its AI models. Partnerships with Oracle, SoftBank, and Nvidia have resulted in the development of Stargate, a data center initiative aimed at meeting rising global demand for computing power. These moves signal OpenAI’s intent to scale its technology for enterprise adoption across industries.

While OpenAI has historically relied heavily on Microsoft as a strategic partner, it has recently broadened its base of alliances. In September, the company announced a tentative agreement with Microsoft concerning future ownership structures but released limited details.

In addition, OpenAI has launched a $50 million grant program for nonprofit organizations, with funding applications closing on October 8. The initiative will support projects that expand public understanding of AI, encourage community-driven use cases, and promote economic opportunity.

Outlook for entrepreneurs and business leaders

OpenAI Valuation at $500 billion marks a major milestone, reflecting how generative AI is reshaping global business strategies. For entrepreneurs and business owners, the company’s trajectory illustrates both the opportunities and risks in the fast-moving AI market. Investor demand suggests confidence that AI technologies will deliver lasting economic impact, but expectations remain high.

OpenAI Valuation reflects the company’s ability to balance rapid growth, attract top talent, and deliver scalable products will be closely watched by industries increasingly integrating AI into operations. As the market continues to expand, the company’s partnerships and ventures position it to play a central role in shaping the future of enterprise AI adoption.

Visit Enterprise Wired for the most recent information.

Sources: