Globalization has brought along many evolutions and advancements in terms of everything. Even sending money internationally has become very convenient. It has become very common as some people send money to support their family abroad, pay for international services, or manage cross-border transactions. There are many ways to send money internationally that will help you save both time and money. Among all these methods it is vital to choose the method that is secure, cost-effective, and convenient as per your preference. In this article, we will explore five popular ways to send money around the globe and also understand their benefits as well as disadvantages.

Top Five Ways to Send Money Internationally:

1. Bank Wire Transfers

A bank wire transfer is one of the most traditional and reliable ways to send money internationally. Most major banks provide this service, allowing customers to transfer funds from their account to a recipient’s account overseas.

How it Works:

You provide your bank with the recipient’s account details, including the IBAN (International Bank Account Number) and SWIFT code, which ensures the funds are sent to the correct institution. The transfer is processed electronically, usually taking 1–5 business days.

Advantages:

- Reliability: Banks have established systems for international transactions, ensuring your money reaches the intended destination.

- Wide Coverage: Banks can transfer money to virtually any country with a functioning financial system.

Drawbacks:

- High Fees: Bank wire transfers often come with steep charges, including transfer fees and unfavorable exchange rates.

- Processing Time: Depending on the banks involved, transfers may take several days.

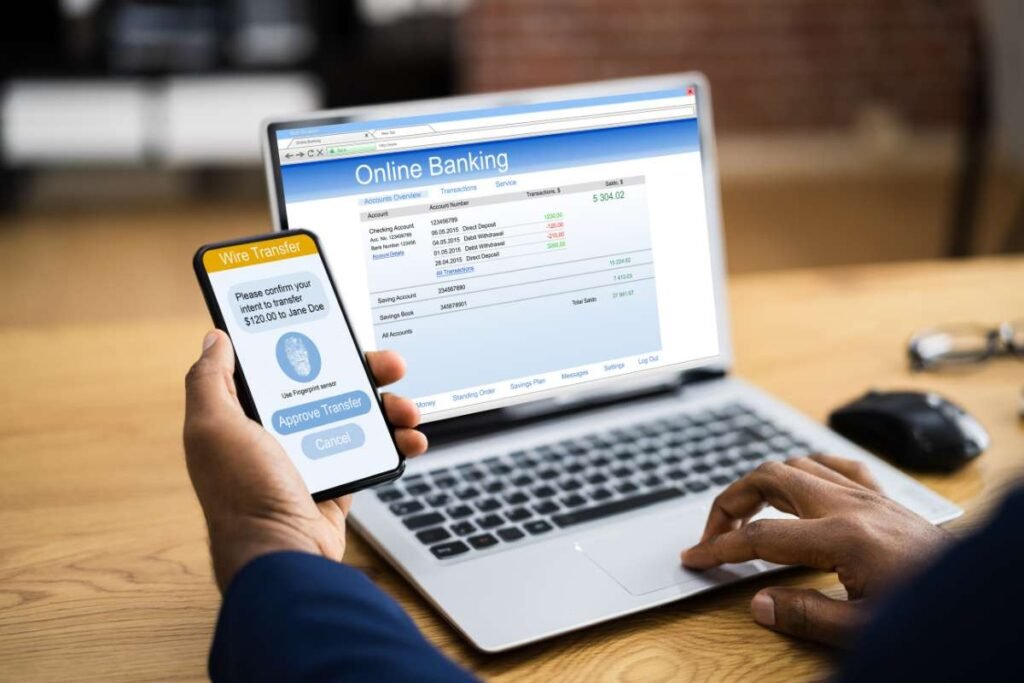

2. Online Money Transfer Services

In the digital age, online money transfer services have emerged as one of the fastest and most convenient ways to send money internationally. Companies like PayPal, Wise (formerly TransferWise), and Revolut offer innovative platforms that make cross-border transactions seamless.

How it Works:

You create an account with the service provider, link your bank account or debit card, and specify the recipient’s details. The service processes the payment and sends it to the recipient’s account, often within minutes.

Advantages:

- Speed: Many online transfer services offer same-day or near-instant transfers.

- Competitive Rates: Platforms like Wise are known for their low fees and mid-market exchange rates, which can save you money compared to traditional banks.

- User-Friendly: These platforms often have intuitive interfaces, making them accessible to anyone.

Drawbacks:

- Digital Dependency: These services require internet access and familiarity with online platforms.

- Limits on Transfers: Some platforms have maximum transfer limits, which may not suit large transactions.

3. Money Transfer Operators (MTOs)

Money Transfer Operators, such as Western Union and MoneyGram, have been a go-to option for sending money internationally for decades. They specialize in cross-border remittances and have a global network of agents and locations.

How it Works:

You visit a physical location or use the operator’s online platform to initiate the transfer. The recipient can then collect the funds at a designated location or have them deposited into their bank account.

Advantages:

- Accessibility: MTOs are ideal for recipients who don’t have bank accounts, as they can collect cash directly.

- Global Reach: With extensive agent networks, MTOs operate in almost every country.

- Speed: Transfers are often processed within minutes.

Drawbacks:

- High Fees: Fees can be significant, especially for smaller transfers.

- Exchange Rate Margins: MTOs may apply less favorable exchange rates, reducing the amount the recipient receives.

4. Cryptocurrency Transfers

For tech-savvy individuals, cryptocurrency provides a modern way to send money internationally. Cryptocurrencies like Bitcoin and Ethereum operate on decentralized blockchain networks, allowing peer-to-peer transactions without intermediaries.

How it Works:

You purchase cryptocurrency on an exchange, send it to the recipient’s wallet address, and they can either hold it or convert it to their local currency.

Advantages:

- Speed: Transfers can be completed within minutes, regardless of the recipient’s location.

- Low Fees: Cryptocurrency transactions often bypass the high fees associated with banks and traditional MTOs.

- Decentralization: No banks or governments control cryptocurrency, offering greater financial freedom.

Drawbacks:

- Volatility: Cryptocurrency values can fluctuate wildly, which might affect the amount received.

- Complexity: Understanding wallets, exchanges, and blockchain technology can be challenging for beginners.

- Limited Adoption: Not all countries or businesses accept cryptocurrency as a payment method.

5. Prepaid Debit Cards

Prepaid debit cards are another practical option for sending money internationally. These cards can be loaded with funds in one country and sent to a recipient abroad, who can use them to withdraw cash or make purchases.

How it Works:

You purchase a prepaid debit card, load it with the desired amount, and mail it to the recipient. Alternatively, some services allow you to transfer funds to a card that the recipient already owns.

Advantages:

- Versatility: The recipient can use the card for both withdrawals and purchases.

- Control: You can limit spending by loading only a specific amount onto the card.

Drawbacks:

- Shipping Delays: If you’re mailing a physical card, delivery can take time.

- Fees: Some prepaid cards come with activation, reload, and ATM withdrawal fees.

Key Considerations When Choosing a Method

When evaluating ways to send money internationally, keep the following factors in mind:

- Cost: Compare fees and exchange rates to determine the total cost of the transfer.

- Speed: If time is critical, opt for methods like online transfers or cryptocurrency.

- Security: Ensure the method you choose complies with regulatory standards and offers robust fraud protection.

- Recipient’s Needs: Consider whether the recipient has access to a bank account, internet, or specific platforms.

Conclusion

The best ways to send money internationally are usually characterized by their cost, speed, and convenience. There are a few traditional modes as well like bank wire transfers and money transfer operators, which have gained popularity because of their reach and reliability. But now people prefer digital methods such as online transfer services and cryptocurrencies to make the process more efficient and affordable.

By evaluating their benefits and drawbacks, you can make the right decision that will adjust as per your financial goal. It is vital to send money internally in the right and secure way Regardless if it’s for your professional or personal reasons.

With the proper process, you will not just save some money but also make sure that the safety and security of your transactions are maintained.