Navigating through the world of finance can be overwhelming and confusing. However, two things come up every time: wealth management vs private banking. They are known to showcase similarities in terms of clients, but they offer different services. For people looking to optimize their financial strategies, understanding the nuances between them is important. Initially, they both work with the same client, but one is focused on banking services while the other is on financial planning and investment. Let’s explore the major differences, helping to clarify how these services can best serve your financial needs.

In this article, we will understand the concept of Wealth management vs private. We will learn more about the differences between these two and also get to know about their pros and cons.

What are wealth management and private banking?

Private banking is a type of financial management service that is offered by various financial institutions to HNWIs and other clients. It is an exclusive type of service, and it is reserved for clients with substantial cash balances and other assets that can either be invested or deposited in the bank. It mainly focuses on traditional banking, such as managing deposits and lending services, but many banks offer personalized services that consider the entire financial circumstances of their HNW clients.

On the other hand, Wealth management means helping an individual grow and protect their assets. Firms that hold expertise in wealth management are known to provide investment advice and financial planning services like retirement planning, estate planning, and tax guidance. Wealth management advisors help their clients build and manage personalized portfolios and also offer niche services like philanthropy planning and insurance consulting. Let’s get more into the differences between wealth management vs private banking.

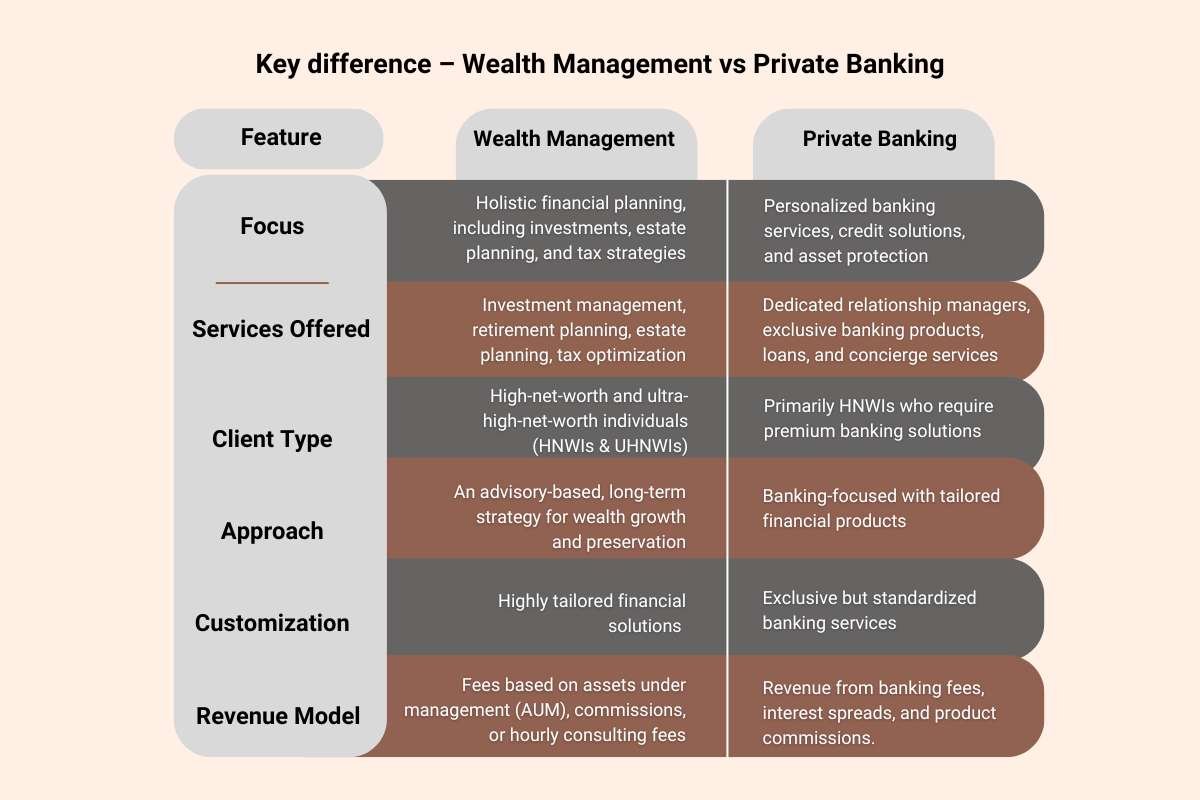

Key difference – Wealth Management vs Private Banking:

Wealth management and private banking both provide their services to high-net-worth individuals, but they serve different financial needs. Wealth management focuses on universal financial planning, which includes investment management, estate planning, tax strategies, and long-term wealth preservation. It is considered typically advisory-based and offers highly customized solutions tailored to an individual’s financial goals. On the opposite end, private banking offers exclusive banking services like premium accounts, credit solutions, and personalized banking assistance with the help of dedicated relationship managers.

Wealth management generates revenue through fees based on assets under management (AUM) or consulting charges, and private banking earns from banking fees, interest spreads, and financial product commissions. Choosing between the two depends on your needs. If you seek strategic financial growth, you can choose wealth management, whereas private banking is for you if you prioritize exclusive banking services and credit solutions. Many high-net-worth individuals benefit from a combination of both for complete financial management.

| Feature | Wealth Management | Private Banking |

| Focus | Holistic financial planning, including investments, estate planning, and tax strategies | Personalized banking services, credit solutions, and asset protection |

| Services Offered | Investment management, retirement planning, estate planning, tax optimization | Dedicated relationship managers, exclusive banking products, loans, and concierge services |

| Client Type | High-net-worth and ultra-high-net-worth individuals (HNWIs & UHNWIs) | Primarily HNWIs who require premium banking solutions |

| Approach | An advisory-based, long-term strategy for wealth growth and preservation | Banking-focused with tailored financial products |

| Customization | Highly tailored financial solutions | Exclusive but standardized banking services |

| Revenue Model | Fees based on assets under management (AUM), commissions, or hourly consulting fees | Revenue from banking fees, interest spreads, and product commissions. |

Learn More: Understanding Transactional vs Transformational Leadership for Effective Management

Pros and cons of Wealth Management vs Private Banking

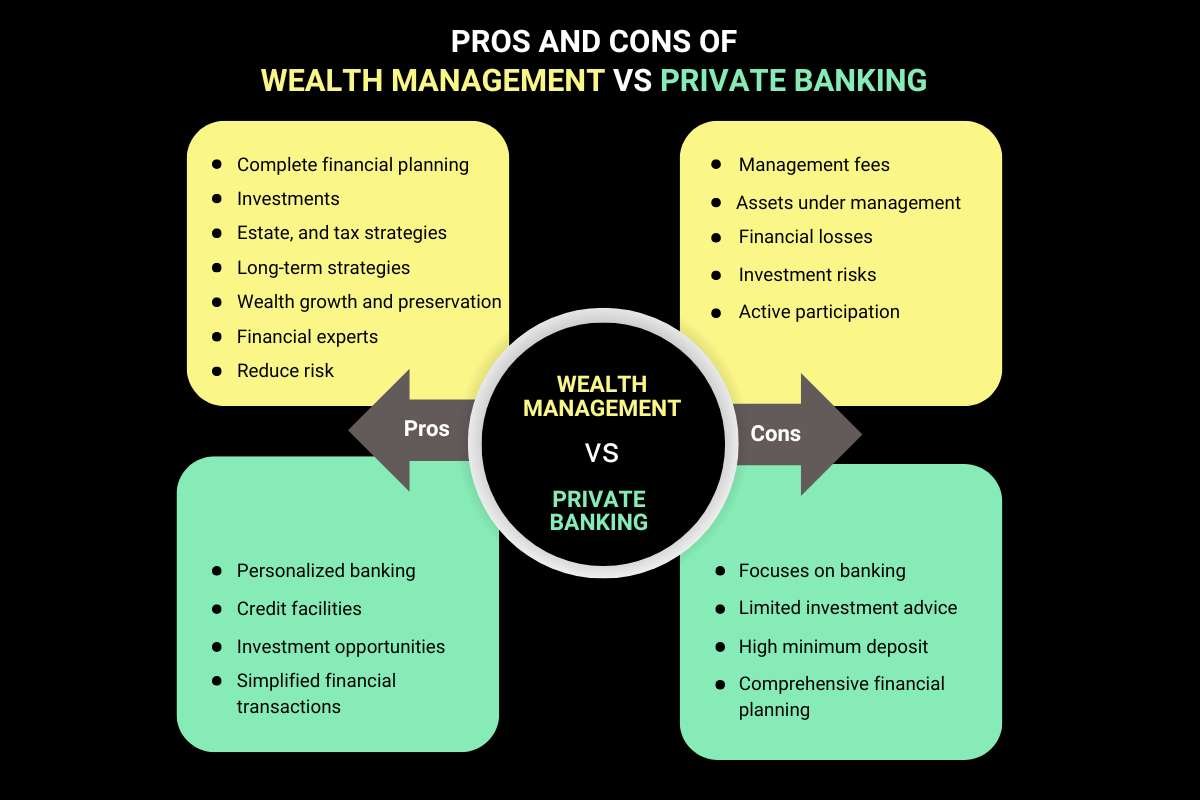

Wealth Management:

Pros:

- Complete financial planning, including investments, estate, and tax strategies.

- Personalized, long-term strategies for wealth growth and preservation.

- Personalized advice from financial experts and investment professionals.

- Diversified asset allocation to reduce risk and optimize returns.

Cons:

- Typically involves management fees based on assets under management (AUM).

- Investment risks can lead to financial losses depending on market conditions.

- Requires active participation and collaboration with advisors.

Learn More: The Essential Project Manager KPIs for Tracking Success

Private Banking:

Pros:

- Personalized banking services with dedicated relationship managers.

- Exclusive access to premium banking products, credit facilities, and investment opportunities.

- Simplified financial transactions with high levels of privacy and discretion.

- Preferential loan rates, concierge services, and other luxury benefits.

Cons:

- Primarily focuses on banking rather than comprehensive financial planning.

- Investment advice may be limited compared to specialized wealth managers.

- Can have a high minimum deposit or asset requirements for eligibility.

- Banking fees and interest charges may add up over time.

Learn More: Mastering People Management Skill: A Key to Leadership Success

Conclusion

Wealth management vs private banking has been a debate in the financial sector. Both of them offer various benefits and personalized services to their clients. To understand the core differences, you need to learn about their services and how they can cater to clients’ needs. Wealth management is commonly known for helping individual with their asset, and private banking is more towards the traditional form of banking. They offer many perks, such as financial planning related to investments, estate, and tax strategies. Also allows access to quality banking products, credit facilities, and investment opportunities. That’s what sets these two different terms apart; you can choose according to your needs and goals.

FAQ:

1. Are private banking and wealth management the same?

What is private wealth management? Private banking is a variety of wealth management. Typically, private banks serve ultra-high net worth (UHNW) individuals – the wealthiest clients – and their family offices and companies. Other wealth management services address high net worth (HNW) individuals and the affluent.

2. What is the difference between wealth management and personal banking?

Wealth managers tend to focus on growing and protecting your assets, ideally with a holistic approach. Private bankers are more focused on traditional banking services that are tailored to the needs of their HNWI clients.

3. What is the difference between a banker and a wealth manager?

Wealth management typically involves tailored financial planning services, investment management, or a combination of both. Private banking usually entails a variety of retail banking services that are typically reserved for high-net-worth or ultra-high-net-worth clients.