When you talk about unforgettable Shark Tank moments, there’s one pitch that still gets people fired up — and that’s James Martin and his company Copa Di Vino. On paper, it was genius: single-serve wine, ready to go, no corkscrew needed. But what happened in the Tank? Well… let’s just say things didn’t exactly go down smoothly.

The First Pour: Copa Di Vino’s Debut (Season 2, 2011)

When James Martin first stepped into the Shark Tank in Season 2, he did so with palpable confidence, presenting Copa Di Vino as a revolutionary solution to enjoying wine. His pitch centered on pre-filled, sealed plastic wine glasses, designed for ultimate convenience. No mess, no fuss—just a perfectly portioned glass of wine ready for picnics, events, concerts, or any occasion where traditional wine service was impractical. James sought $600,000 for a 30% stake in his company, and the Sharks, particularly wine enthusiast Kevin O’Leary, were visibly intrigued. They sampled the wine and were impressed by its quality, but it was the innovative cup technology that truly captured their interest.

However, a fundamental disagreement quickly emerged. The Sharks weren’t keen on investing in the entire wine business; their focus was on the patented cup technology itself. Offers quickly shifted toward a licensing deal for the cup, suggesting James take the wine out and concentrate on the packaging, allowing them to control and scale the technology globally. But James was unwavering. He famously declared, “I’m not selling my soul,” believing that Copa Di Vino’s true value lay in the integrated package—the wine and the cup. He refused to split his business or cede control, ultimately walking away from the Tank and leaving the Sharks in stunned disbelief.

The Return: Season 3, 2012 – Round 2

In a surprising turn of events, James Martin returned to the Tank in Season 3. This time, his proposal seemed to align with the Sharks’ original desire: he was offering a licensing deal for the cup technology. One might expect a warm reception, but the atmosphere was anything but amicable. The Sharks felt a profound sense of disrespect and manipulation. They believed James was simply seeking a free consultation, having already dismissed their advice.

The trust was clearly gone. Kevin O’Leary, vocal as ever, didn’t hold back, famously calling James “greedy and stupid” for rejecting millions in the first pitch. Despite James’s attempts to explain his post-show sales surge, which he felt validated his original integrated model, the Sharks were no longer receptive. Any offers were stingy and contingent on complete control, terms James was still unwilling to accept. Consequently, his second appearance concluded with an even more acrimonious exit, solidifying his reputation as a founder unwilling to compromise on his vision.

Beyond the Tank: What Happened After?

Despite the dramatic and highly public rejections, Copa Di Vino’s story was far from over. The powerful “Shark Tank Effect” undeniably kicked in, providing the company with immense exposure. This free national publicity translated into significant growth, with Copa Di Vino reportedly achieving millions in sales. The product proved its viability, finding distribution in various retail stores, airlines, and stadiums, demonstrating a clear demand for convenient, ready-to-drink wine. James had, in a way, proven that his integrated vision had market appeal.

However, building and scaling a beverage brand is an arduous undertaking, especially without substantial investor backing. The complexities of production, distribution, and navigating a competitive market are immense. Ultimately, in 2019, Copa Di Vino was sold to Splash Beverage Group. While the specific financial details weren’t widely publicized, this acquisition marked the end of James Martin’s independent ownership. The question lingers among fans and entrepreneurs alike: was this a win that validated his stubbornness, or did he leave a far more lucrative opportunity on the table by not forging a partnership with the Sharks?

Lessons from the Copa Di Vino Saga

The Copa Di Vino pitches offer a compelling case study for any aspiring entrepreneur, providing invaluable insights into the dynamics of investor relations and strategic decision-making:

- Founder’s Vision vs. Investor Reality: The core conflict stemmed from James’s unwavering belief in building an entire wine brand (wine + cup) versus the Sharks’ desire to scale the highly defensible patented cup technology separately. This highlights the crucial need for founders to understand how investors perceive value and to be adaptable in their approach to maximize potential.

- The Power (and Price) of Control: James fiercely guarded his control over Copa Di Vino. While admirable for maintaining his vision, this stance came at a cost, potentially sacrificing significant capital, strategic partnerships, and accelerated growth that could have been achieved with investor collaboration.

- The “Shark Tank Effect” is Real: Copa Di Vino is a prime example that securing a deal isn’t the only path to success on Shark Tank. The massive free exposure alone can lead to a substantial spike in sales and brand recognition, proving the show’s marketing power.

- Relationships Matter: The breakdown of trust in the second pitch serves as a stark reminder that business is built on relationships. Burning bridges, even with potential partners, can close doors that might otherwise lead to future opportunities. Second impressions, especially after a controversial first, are critical.

The Copa Di Vino pitch remains one of Shark Tank’s most talked-about moments, a powerful illustration of entrepreneurial conviction clashing with investment pragmatism. What other Shark Tank pitches do you think offer such profound business lessons?

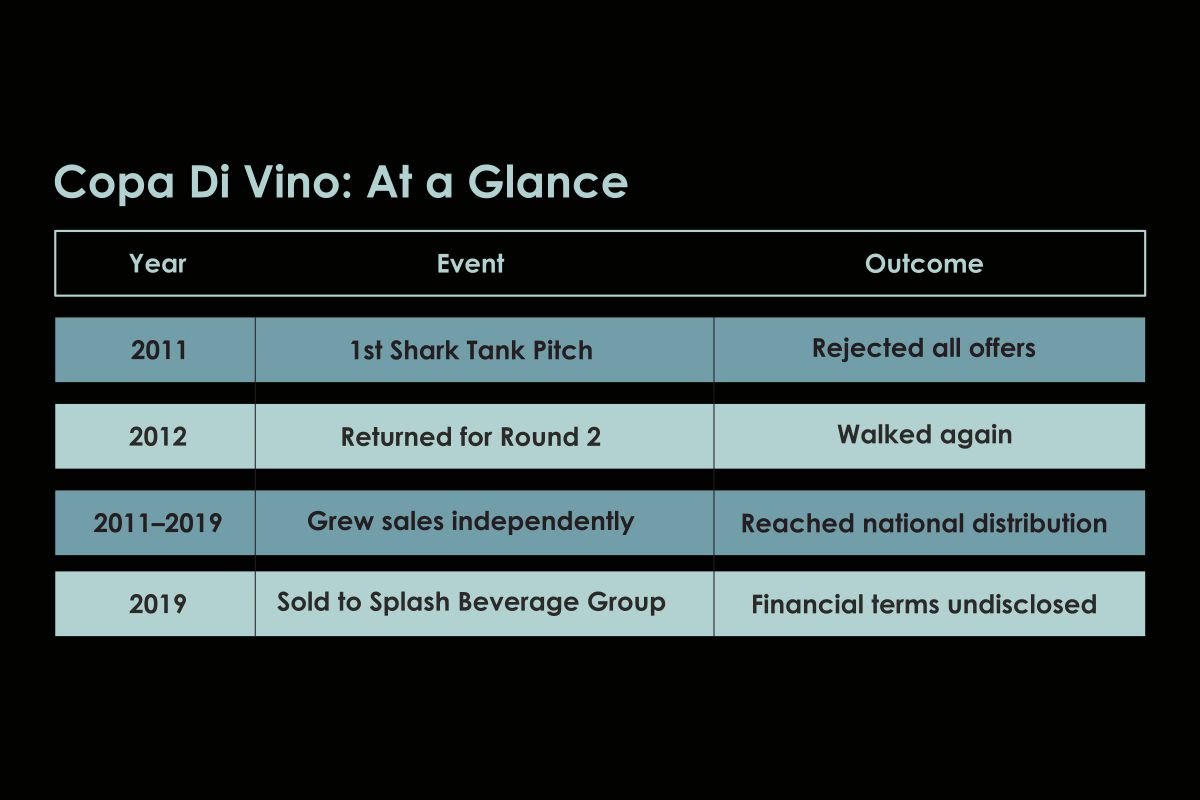

Copa Di Vino: At a Glance

| Year | Event | Outcome |

| 2011 | 1st Shark Tank Pitch | Rejected all offers |

| 2012 | Returned for Round 2 | Walked again |

| 2011–2019 | Grew sales independently | Reached national distribution |

| 2019 | Sold to Splash Beverage Group | Financial terms undisclosed |

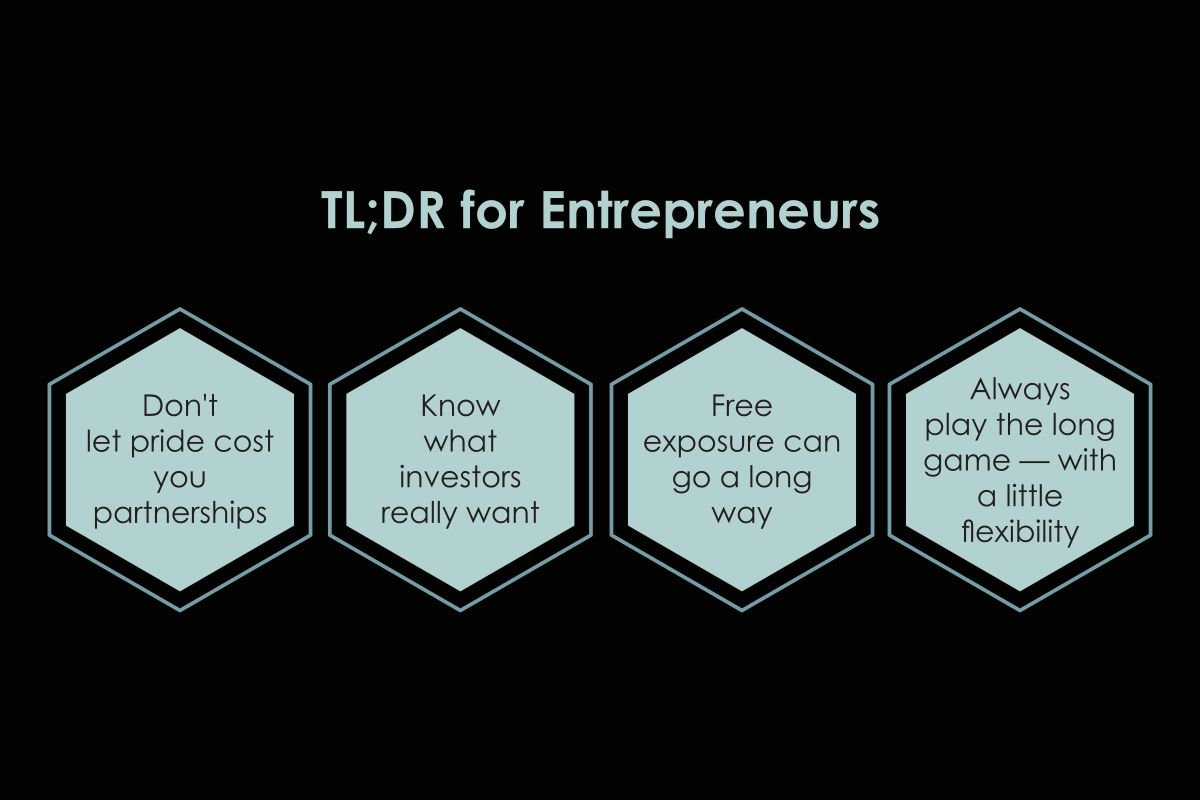

TL;DR for Entrepreneurs:

- Don’t let pride cost you partnerships

- Know what investors really want\

- Free exposure can go a long way

- Always play the long game — with a little flexibility

Final Sip: Was It Worth?

James Martin did prove there was a market for wine in a cup. He did scale a business on his own. And he did get acquired.

But did he miss out on growing faster, bigger, and with less stress by refusing the Sharks? Possibly.

This story’s not just about wine — it’s about vision, ego, risk, and reward.