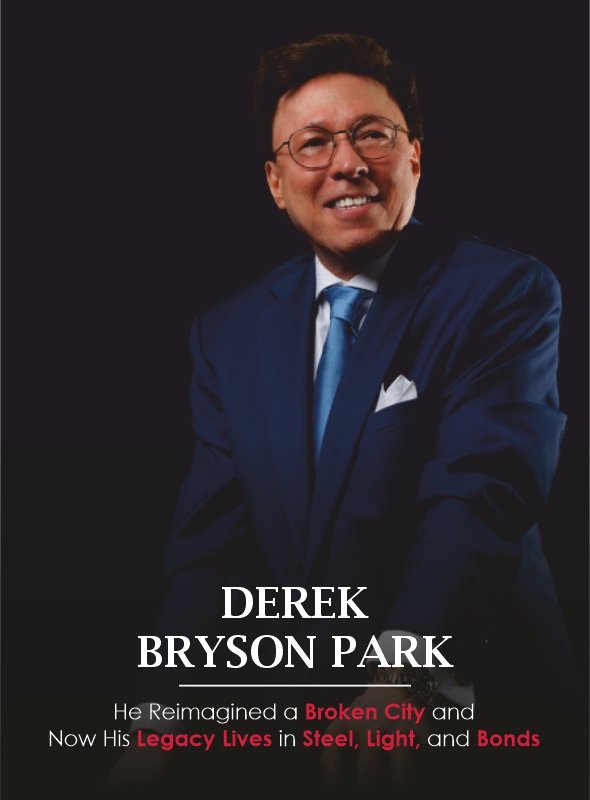

Derek Bryson Park

He Reimagined a Broken City and Now His Legacy Lives in Steel, Light, and Bonds

A Decade of Urban Transformation

It was the early 2000s, and the city that never sleeps was holding its breath. Streets echoed with silence where there should’ve been sirens, ambition, and bustle. Lower Manhattan, shaken by the unthinkable, faced not just the debris of buildings but the collapse of confidence.

While the world turned to emergency responders and military might, New York’s long recovery would be shaped, in part, by an unassuming man in a suit, Derek Bryson Park.

As Acting Chairman of the New York City Industrial Development Agency (IDA) from 2000 to 2010, Park quietly became one of the most influential financial figures in the city’s modern history. His leadership helped move more than $40 billion in municipal bond issuances, making the IDA the second-largest issuer of municipal debt in the United States, behind only the state of California. However, this is not just a story about money. This is a story about rebuilding the soul of a city.

Times Square: A Decade-Long Battle to Reclaim the Crossroads of the World

Before the LED lights, Broadway glamour, and pedestrian plazas, Times Square was the bruised heart of a city trying to forget the 1970s. Crime-ridden, chaotic, and avoided by its own residents, the world-famous intersection had become a symbol of New York’s decay.

However, Derek saw something else.

He envisioned Times Square not just as a real estate project but as a national redemption arc. Over the course of a decade, Derek, through his role at the IDA, oversaw $500 million in funding that transformed the area into what urban developers now call the largest urban redevelopment project in U.S. history.

He coordinated between government agencies, developers, law enforcement, and private investors to orchestrate a transformation that is now studied in universities and replicated across continents. Today, Times Square welcomes over 50 million visitors annually, generates billions in economic output, and is affectionately known as “The Crossroads of the World.”

But Park doesn’t boast. “That project is my proudest,” he admits, with the reserved humility of a man who knows his fingerprints are etched in the skyline.

Financing Legacy: Two Stadiums, One City, and a Billion-Dollar Home Run

The next challenge was a symbolic one.

In an unprecedented move, Park orchestrated the complex, high-stakes municipal financing that led to the creation of two new Major League Baseball stadiums: Yankee Stadium and Citi Field, homes to the Yankees and Mets, respectively.

Working alongside Randy Levine, President of the New York Yankees, and David Cohen, Executive Vice President of the Mets, Park helped secure $1.6 billion in tax-exempt bond financing, a feat of negotiation, foresight, and financial engineering. At a time when few believed large-scale sports infrastructure could coexist with post-9/11 austerity, Park turned skepticism into strategy.

The result? A pair of world-class stadiums that didn’t just elevate sports experiences but catalyzed neighborhood redevelopment, job creation, and civic morale.

In 2006, Park, Levine, and Cohen were honored with The Bond Buyer’s Deal of the Year award—the municipal finance industry’s highest honor.

“Baseball is part of New York’s DNA,” Park reflected. “This wasn’t just steel and concrete, it was about restoring identity after trauma.”

Securing Wall Street: The New York Stock Exchange Expansion

If Times Square was about civic rebirth and the stadiums about cultural pride, then the expansion of the New York Stock Exchange was about securing the financial soul of the nation.

Park, as Acting Chairman of the IDA, oversaw the $300 million structural expansion of the NYSE, ensuring its post-9/11 physical and operational security. This wasn’t just architecture, it was symbolism. At a time when global markets were watching closely, New York sent a clear signal: the world’s financial epicenter would not just endure, it would evolve.

“Wall Street had to project strength,” Park said. “That expansion wasn’t just construction—it was reassurance.”

Understanding the Power of the Bond

To truly grasp Derek’s contribution, you must first understand the subtle power of municipal bonds.

While most focus on stock markets and splashy IPOs, he understood that fixed income markets, especially municipal bonds, are the lifeblood of American infrastructure. Representing only 20–25% of the total capital markets, stocks might steal headlines, but it’s the $105 trillion fixed income market that builds bridges, funds hospitals, powers schools, and—under Derek’s hand—reimagined a city.

Municipal bonds offer tax-free returns to investors and fuel long-term projects without burdening taxpayers. Derek’s tenure saw the IDA fund:

- Brooklyn Bridge Park ($300M): A reclaimed waterfront transformed into a world-class public space.

- Hudson Yards Development ($1.5B): A futuristic neighborhood rising from old rail yards.

- High Line Redevelopment ($170M): An abandoned rail line reimagined as a green pedestrian highway.

- World Trade Center Redevelopment ($15B): More than a rebuild—this was a rebirth.

- East Side Access Project ($8B): A massive transit solution connecting Long Island Rail Road to Grand Central Terminal.

- Affordable Housing Projects ($2B): Ensuring the working class wasn’t priced out of the city it helped build.

- Environmental Initiatives like the Gowanus Canal cleanup ($500M) and green infrastructure upgrades ($200M).

This wasn’t just economic development. This was urban reinvention, anchored by a man who understood the mechanics of capital and the dreams of cities.

Appointments across Political Divides

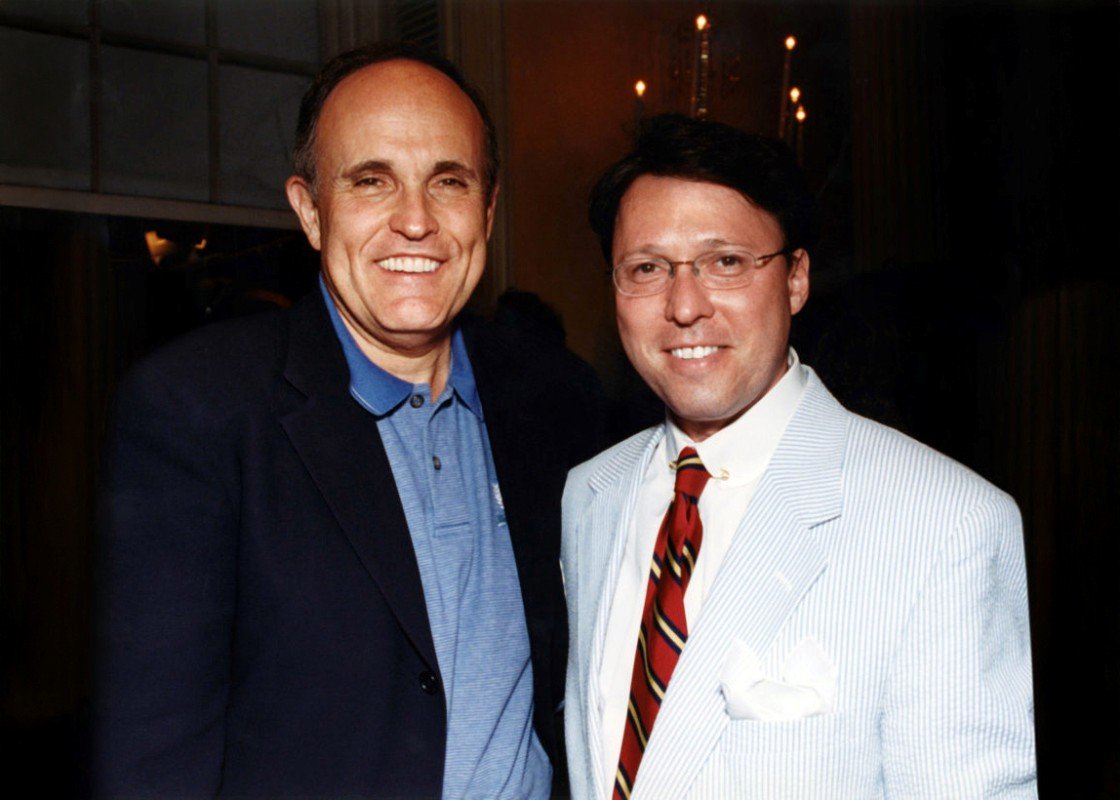

As the world was growing increasingly polarized, Derek’s appointments read like a model of bipartisan trust. He was appointed by the Giuliani administration and continued under Mayor Bloomberg, serving three New York Governors—George Pataki, Eliot Spitzer, and David Paterson.

He simultaneously held the posts of:

- Acting Chairman of the New York City Industrial Development Agency (IDA)

- Vice Chairman of the New York Capital Resource Corporation

- Director and Executive Committee Member of the NYC Economic Development Corporation

These roles weren’t ceremonial. They reflected real decision-making and a real legacy.

Legacy in Steel, Light, and Quiet Impact

Derek doesn’t tweet his accomplishments. He doesn’t seek headlines or prime-time interviews. Yet his influence looms over every part of modern New York—from the bustle of Times Square to the roar of Yankee Stadium, from the silent security of Wall Street to the rising neighborhoods of Queens and Brooklyn.

He reminds us that public service isn’t always publicized, but when done right, it is immortalized in city skylines, community parks, transit hubs, and affordable homes.

In his decade as Acting Chairman of the IDA, Park helped write a playbook that other cities still study. One where capital markets serve people, where tax-exempt bonds rebuild nations, and where infrastructure becomes identity.

In the end, Park didn’t just fund New York. He fortified it with vision, discipline, and the steady hand of a man who knew that real power doesn’t shout. It builds.

Share Post: