Beijing takes action to stimulate demand and boost growth

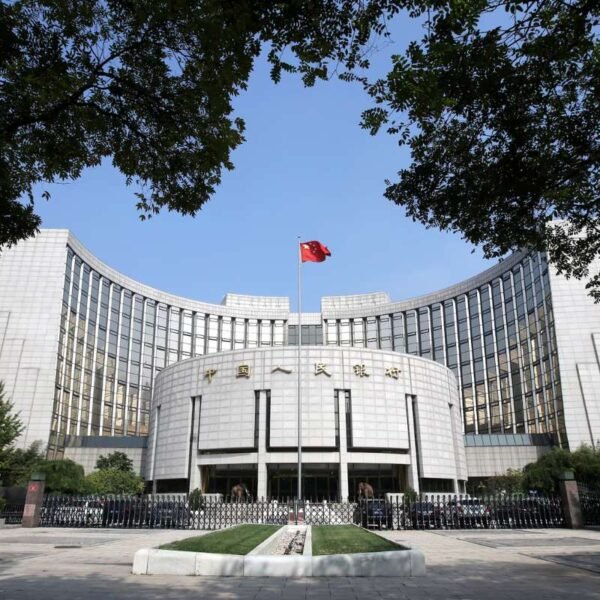

Major Rate Cuts by PBOC

On Monday, China’s central bank, the People’s Bank of China (PBOC), announced a reduction in its main benchmark lending rates by 25 basis points during the monthly fixing. The one-year loan prime rate (LPR), which influences corporate and most household loans, was lowered to 3.1%, while the five-year LPR, the benchmark for mortgage rates, was cut to 3.6%. These changes signal China’s continued efforts to stimulate its sluggish economy through monetary policy adjustments.

This move had been widely anticipated after PBOC Governor Pan Gongsheng hinted at a possible rate reduction during a recent forum in Beijing. He noted that the central bank was likely to lower the loan prime rates by 20 to 25 basis points. This reduction follows similar cuts in previous months and is part of a broader strategy to address ongoing economic challenges, including a persistent property crisis and weak consumer confidence.

Analysis: Stimulus and Economic Strategy

The PBOC’s decision to cut Lending rates is part of a larger monetary stimulus plan aimed at stabilizing China’s economy. Along with the LPR cuts, Governor Pan also mentioned the potential for further reductions in the reserve requirement ratio (RRR) by 25 to 50 basis points by the end of the year, depending on liquidity needs. Additional measures, including a 20-basis-point cut to the seven-day reverse repurchase rate and a 30-basis-point reduction in the medium-term lending facility rate, were highlighted during his speech.

While the rate cuts are a positive step, experts believe more substantial measures are needed. Shane Oliver, chief economist at AMP, emphasized that lowering the cost of borrowing alone might not be enough to stimulate significant growth. He stressed that China’s real challenge lies in a lack of demand, calling for more aggressive fiscal stimulus to complement the monetary adjustments. Zhiwei Zhang, president of Pinpoint Asset Management, echoed this sentiment, arguing that despite the recent cuts, China’s real interest Lending rates remain too high. He expects additional rate reductions in 2024 as the U.S. Federal Reserve begins to lower its own rates.

Context: China’s Economic Landscape

China’s latest move to cut lending rates comes after a series of measures taken by the PBOC to support its economy, which has been grappling with multiple crises, including a prolonged slump in the property market. Last month, the central bank lowered the RRR by 50 basis points, releasing liquidity into the banking system to help ease financial pressures. These efforts are aimed at boosting consumer spending and investment, as the world’s second-largest economy struggles to regain its footing.

Recent economic data provides a mixed picture. While China’s third-quarter GDP growth of 4.6% year-on-year was slightly better than expected, the overall sentiment remains cautious. Retail sales and industrial production figures for September also exceeded forecasts, offering some hope. However, experts believe that without stronger demand and more comprehensive fiscal support, China’s economic recovery may remain slow.

The PBOC’s recent actions, including the latest rate cuts, reflect its commitment to stabilizing the economy. However, the road to recovery remains uncertain, with many calling for a balanced approach that includes both monetary and fiscal policy initiatives to address the underlying structural issues.