Source – inkl.com

Fed’s Anticipated Rate Cuts Not Delivering Expected Relief

The Federal Reserve’s recent efforts to ease the U.S. debt burden through rate cuts have not yet produced the expected results. Last month, when the Fed began cutting interest rates, many expected bond yields to decline, which would have reduced the financial strain from the country’s growing debt. However, the opposite has occurred. Despite the Fed’s initial rate cut, Treasury yields have risen instead of falling, increasing the pressure on the U.S. government’s borrowing costs.

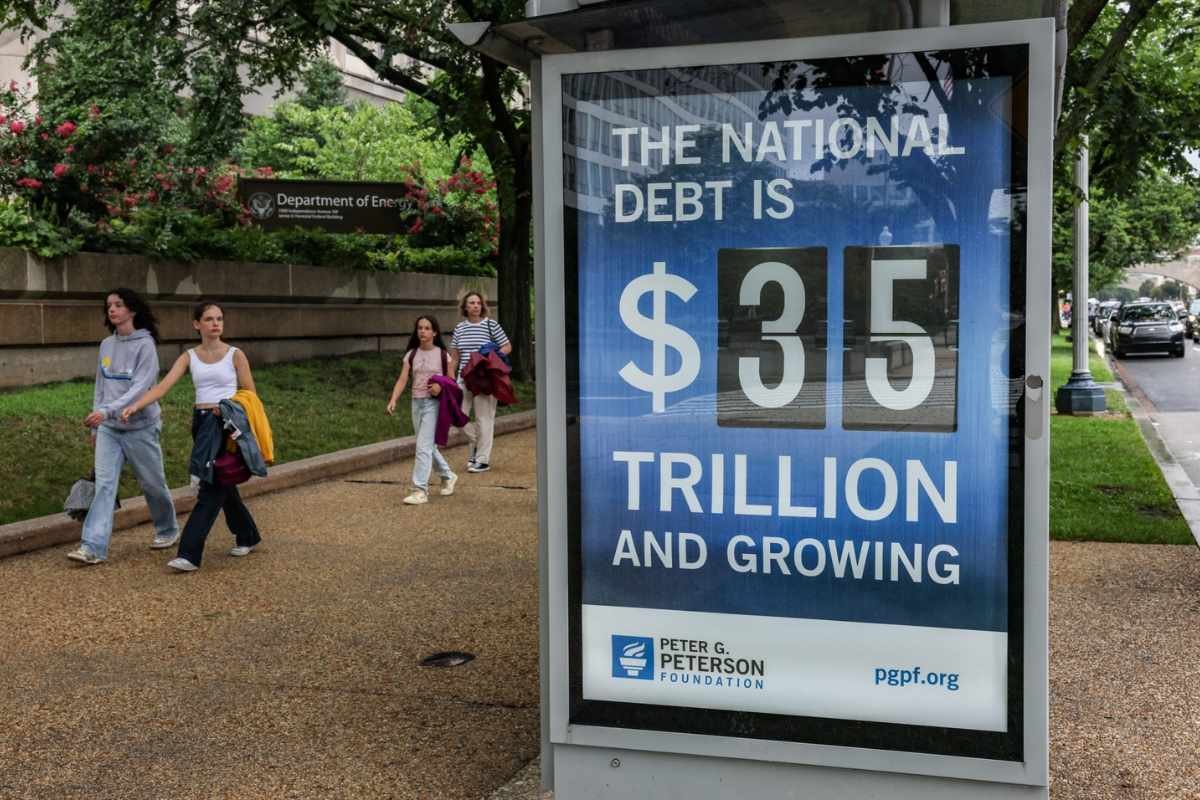

The U.S. debt now stands at a staggering $35.3 trillion, with interest expenses averaging $3 billion per day. Just two years ago, daily interest expenses were closer to $2 billion, largely due to the Fed’s aggressive rate hikes aimed at controlling inflation. At the time, Torsten Sløk, chief economist at Apollo Global Management, expressed hope that rate cuts would ease this burden. He estimated that a 1% cut in rates could reduce daily interest expenses by $500 million. However, these anticipated savings have yet to materialize.

Fed Actions and Market Reactions: Yields Rise Instead of Falling

Initially, market expectations were high for a series of aggressive rate cuts, with Treasury yields falling in anticipation. However, after the first cut, the situation shifted. Yields on the 10-year and 2-year Treasury bonds both rose sharply. The 10-year yield climbed by about 50 basis points, reaching nearly 4.1%, while the 2-year yield increased by 40 basis points to around 3.95%. These increases are significant because Treasury yields directly impact the government’s ability to finance new debt.

The rising yields come amid signals from the Federal Reserve that further cuts may not be as forthcoming as the market had hoped. The central bank’s “dot plot” projections suggested fewer cuts than anticipated, and Fed Chair Jerome Powell downplayed the likelihood of an aggressive easing cycle. In subsequent statements, Powell emphasized that the Fed is in no rush to continue lowering rates, adding to concerns that higher borrowing costs could persist.

Economic data has also complicated the outlook for rate cuts. A strong jobs report last week pointed to a resilient economy, with employers continuing to demand more workers despite higher wages. Additionally, the latest Consumer Price Index report showed inflation cooling but remaining stickier than expected, which could delay further rate cuts.

Future Outlook: U.S. Debt and Deficits Still Set to Grow

The increase in Treasury yields has added to the already significant burden of servicing U.S. debt, which reached $950 billion for the fiscal year ending September 30—a 35% increase compared to the previous year. This growing expense has contributed to a federal budget deficit of $1.8 trillion for the year. Even if rate cuts eventually lower interest payments, analysts warn that the next administration is expected to exacerbate budget deficits.

According to a recent analysis by the Penn Wharton Budget Model, both Donald Trump and Kamala Harris are projected to increase deficits if elected. Under Trump’s proposals, the deficit could expand by as much as $5.8 trillion over the next decade. Harris’ policies would also increase deficits, though at a lower rate, with estimates ranging from $1.2 trillion to $2 trillion over the same period.

In the coming months, much will depend on whether the U.S. economy shows signs of significant weakening, which could prompt a more aggressive series of rate cuts. However, with the debt burden continuing to grow and the political landscape unlikely to produce significant fiscal restraint, the challenges of managing U.S. debt appear far from over.