Venture Capital Trends Shaping the IoT Market in 2026

Venture Capital IoT 2026 is driving unprecedented growth in the connected technology landscape. Look around, and you will see connected technology everywhere. Homes adjust temperature automatically, factories monitor machines in real-time, doctors track patients remotely, and cities manage traffic more efficiently through connected devices and sensors. In 2026, venture capital investors see massive potential in this space. Billions were invested in Internet of Things (IoT) startups last year, and funding is expected to grow more this year.

The reason is simple. IoT is solving real, visible problems. Factories can detect issues before machines fail. Hospitals can monitor patients without keeping them admitted. Cities can manage traffic, lighting, and energy more efficiently.

This article looks at the key venture capital trends shaping the IoT market today, where the money is going, why it matters, and what it means for startups and businesses.

Why Venture Capital Is Flowing into IoT?

Venture Capital IoT 2026 is attracting investors because delivers clear business value. Global IoT spending crossed $1 trillion in 2025 and is expected to reach $1.5 trillion by 2030. Leading VC firms like Andreessen Horowitz and Sequoia see how connected devices reduce costs and improve efficiency.

A simple example is predictive maintenance. One sensor network can alert a factory before a machine breaks down, saving millions in lost production. Firms such as SOSV, which has backed over 2,800 IoT-related startups, and Cisco Investments focus on companies that can show quick and measurable results. Last year, strong IoT startups raised funding rounds ranging from $30 million to $60 million.

Much of this interest comes from businesses looking for tools that work well with AI and 5G networks, making data faster, smarter, and more useful.

AI and Edge Computing Gain Momentum

One of the biggest areas of investment in Venture Capital IoT 2026 is edge computing combined with AI. Instead of sending all data to distant cloud servers, devices process information close to where it is collected. This reduces delays, lowers costs, and improves reliability.

In 2025, edge AI startups raised hundreds of millions in funding. Intel Capital backed several companies building smart sensors for vehicles, drones, and industrial systems. Actility, for example, raised $26 million to support large-scale device connectivity with minimal delay.

This matters because factories need instant alerts when equipment overheats, and autonomous systems require split-second decisions. As 5G becomes more widespread, edge-based IoT is expected to grow at around 15 percent per year. Many startups in this space also attract attention from large tech companies looking for acquisitions.

Healthcare IoT Attracts Strong Investor Interest

Healthcare has become one of the most attractive IoT sectors for investors. Remote patient monitoring grew rapidly during the pandemic and has now become a standard part of care. Wearable devices can track heart rate, oxygen levels, and movement, sending data directly to doctors.

Artisight raised $51 million to expand hospital sensors and camera systems that help detect falls, infections, or early signs of illness. Investors see strong demand here, especially as aging populations need continuous care without overcrowding hospitals.

Major players like Microsoft and Google Ventures are investing heavily in this space. Digital health deals are expected to cross $10 billion this year. Trials have shown that simple monitoring devices can reduce hospital readmissions by nearly 30 percent. For startups, this opens doors to partnerships with hospitals, insurers, and healthcare providers, making Venture Capital IoT 2026 a key driver in this growing market.

Smart Factories and Connected Supply Chains

Industrial IoT is reshaping manufacturing and logistics. Sensors on machines can predict failures before they happen, helping companies avoid costly downtime that can exceed $50,000 per hour.

Bosch and Honeywell Ventures have invested heavily in companies like Augury, which raised $180 million for vibration monitoring technology. Supply chains also benefit from real-time tracking of goods from production to delivery, reducing waste and delays.

In 2025, funding for industrial IoT in logistics doubled, driven largely by manufacturing growth in Asia. Investors expect more deals focused on predictive maintenance and operational efficiency as companies aim for smoother, interruption-free operations.

Smart Cities Draw Growing Investment

Cities around the world are using IoT to improve traffic flow, reduce energy use, and manage waste more effectively. Venture capital is backing startups that connect streetlights, traffic signals, and public transport systems.

Companies supported by Siemens and other investors raised over $100 million for urban technology platforms last year. Projects like Singapore’s smart city initiatives have already reduced traffic congestion by 20 percent, leading to cleaner air and a better quality of life, , highlighting the growing impact of Venture Capital IoT 2026 in urban innovation.

Sustainability is a major driver here. Green IoT solutions attract investors focused on climate impact. By 2026, investments in smart city technology could reach $50 billion, creating jobs and making cities more livable.

Security Becomes a Top Priority

As IoT adoption grows, security has become non-negotiable. Connected devices are frequent targets for cyberattacks, especially in factories and critical infrastructure. Investors now expect strong security measures from the start.

Cybersecurity firms like Claroty raised $400 million as attacks on industrial systems increased sharply. Many investors favor zero-trust security models, where every device must verify itself before accessing a network.

For startups, building security into the product from day one is no longer optional, making Venture Capital IoT 2026 increasingly tied to secure, trustworthy solutions.

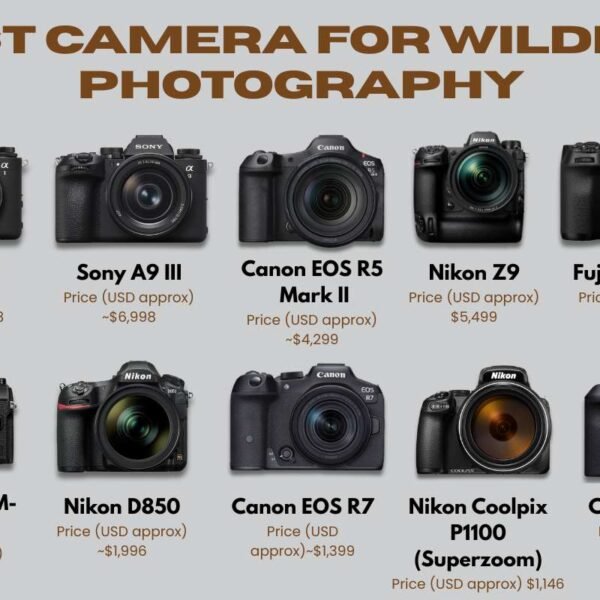

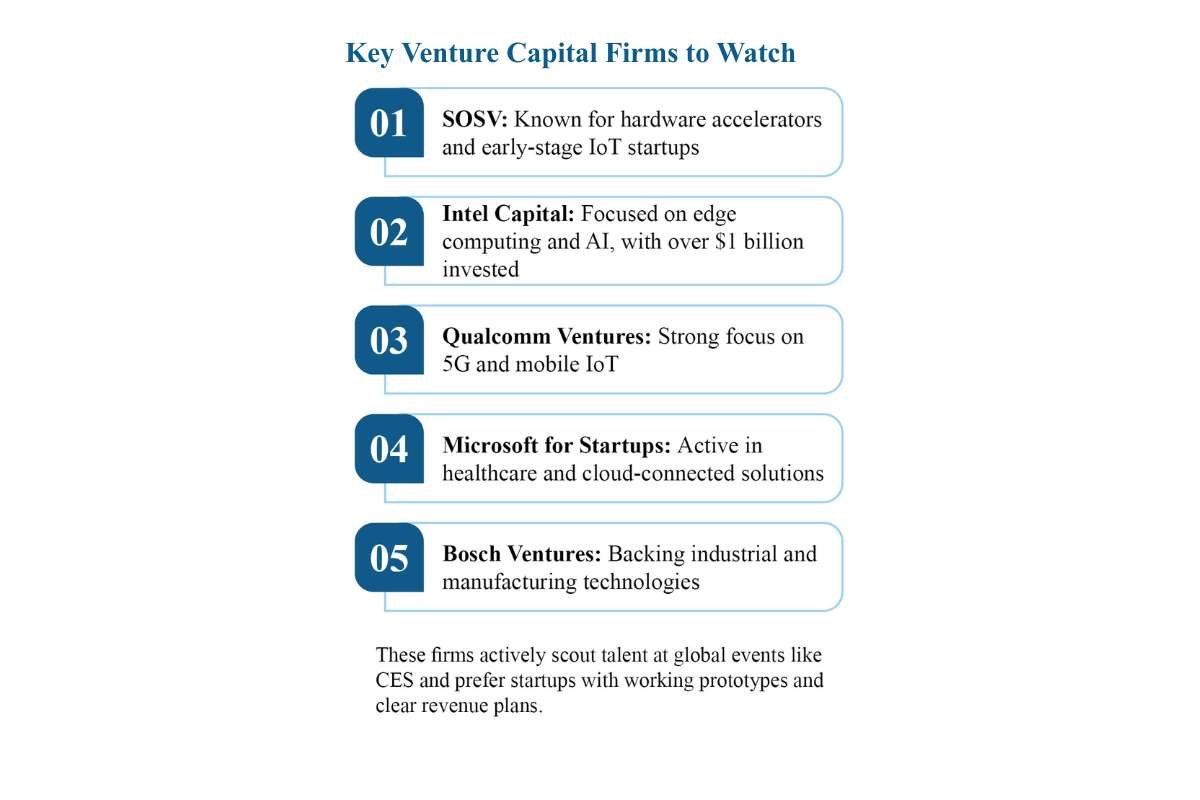

Key Venture Capital Firms to Watch

Several investors are shaping the future of IoT:

- SOSV: Known for hardware accelerators and early-stage IoT startups

- Intel Capital: Focused on edge computing and AI, with over $1 billion invested

- Qualcomm Ventures: Strong focus on 5G and mobile IoT

- Microsoft for Startups: Active in healthcare and cloud-connected solutions

- Bosch Ventures: Backing industrial and manufacturing technologies

These firms actively scout talent at global events like CES and prefer startups with working prototypes and clear revenue plans.

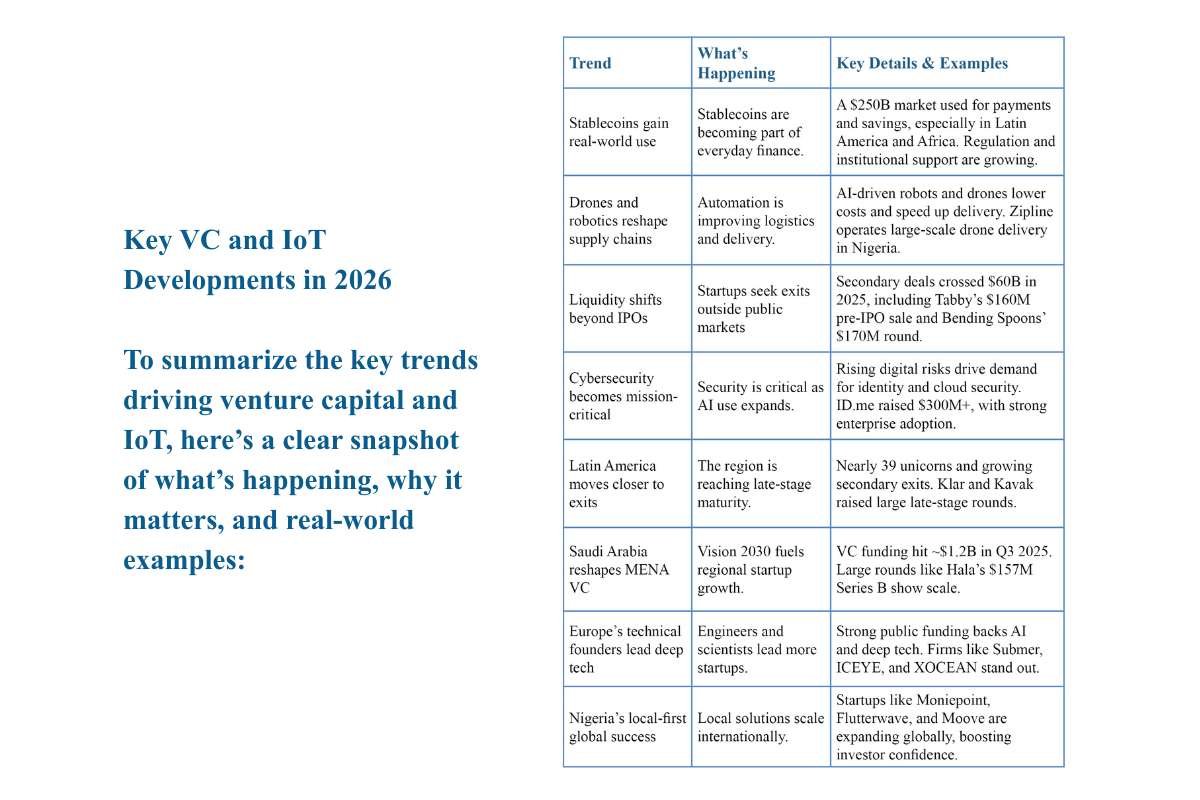

Key VC and IoT Developments in 2026

To summarize the key trends driving venture capital and IoT, here’s a clear snapshot of what’s happening, why it matters, and real-world examples:

| Trend | What’s Happening | Key Details & Examples |

| Stablecoins gain real-world use | Stablecoins are becoming part of everyday finance. | A $250B market used for payments and savings, especially in Latin America and Africa. Regulation and institutional support are growing. |

| Drones and robotics reshape supply chains | Automation is improving logistics and delivery. | AI-driven robots and drones lower costs and speed up delivery. Zipline operates large-scale drone delivery in Nigeria. |

| Liquidity shifts beyond IPOs | Startups seek exits outside public markets | Secondary deals crossed $60B in 2025, including Tabby’s $160M pre-IPO sale and Bending Spoons’ $170M round. |

| Cybersecurity becomes mission-critical | Security is critical as AI use expands. | Rising digital risks drive demand for identity and cloud security. ID.me raised $300M+, with strong enterprise adoption. |

| Latin America moves closer to exits | The region is reaching late-stage maturity. | Nearly 39 unicorns and growing secondary exits. Klar and Kavak raised large late-stage rounds. |

| Saudi Arabia reshapes MENA VC | Vision 2030 fuels regional startup growth. | VC funding hit ~$1.2B in Q3 2025. Large rounds like Hala’s $157M Series B show scale. |

| Europe’s technical founders lead deep tech | Engineers and scientists lead more startups. | Strong public funding backs AI and deep tech. Firms like Submer, ICEYE, and XOCEAN stand out. |

| Nigeria’s local-first global success | Local solutions scale internationally. | Startups like Moniepoint, Flutterwave, and Moove are expanding globally, boosting investor confidence. |

What This Means for IoT Startups?

Investors are seeking IoT companies that can scale rapidly and partner with major enterprises. Startups focused on healthcare, manufacturing, or logistics tend to experience faster adoption. While funding slowed briefly in mid-2025, conditions are improving in 2026 as interest rates ease.

Founders should focus on real-world demonstrations rather than polished slides. Data privacy and regulations remain challenges, but the opportunity is far larger. IoT is expected to add up to $11 trillion to the global economy by 2030.

For startups, the message is clear. Build practical solutions, test them in real environments, and connect with the right investors. In this context, Venture Capital IoT 2026 highlights the importance of funding those who can turn innovative ideas into real-world impact.