Traditional markets, with their familiar structures and centralized gatekeepers, often feel like well-charted waters—safe and sometimes slow. Yet, beyond this conventional horizon lies a new frontier, Decentralized Exchange (DEX). However, it demands a deeper, more nuanced understanding than a simple trading book can provide. This is the wild, often untamed territory of peer-to-peer trading.

Venturing into this space without a compass is a recipe for disaster. The most critical insights aren’t published in whitepapers or whispered by analysts. No, they are found in the crucible of real-world experience, often hidden in the complex mechanics of a DEX. These are the hard-won secrets, the subtle market behavior, and the security protocols of a self-custodial environment. Prepare to learn the essential lessons about DEX that the market often teaches only through costly mistakes.

What is a Decentralized Exchange? Understand Core Concepts of DEX?

A DEX is a type of cryptocurrency exchange that allows users to trade digital assets directly with each other on a blockchain network. It operates without a centralized authority or intermediary. It doesn’t require a KYC or personal identification. Every trade incurs a blockchain transaction fee and a trading fee, a portion of which goes to liquidity providers.

In essence, decentralized exchanges form the core of decentralized finance (DeFi). It is essentially reshaping how users trade digital assets while enabling self-sovereign financial control.

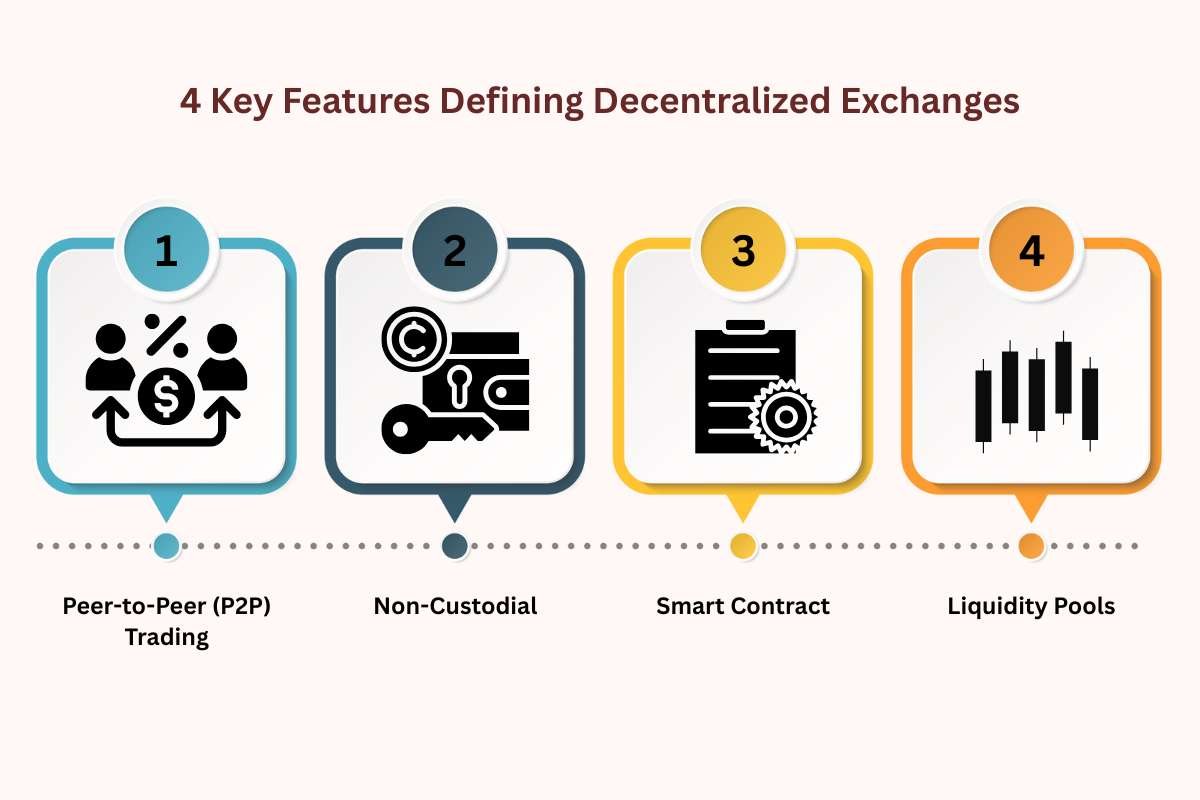

Here are key characteristics of DEX that you must understand:

- Peer-to-Peer (P2P) Trading: Instead of trusting a company to hold and manage your funds, DEXs facilitate direct trades between individual users.

- Non-Custodial: This is the most critical difference. Users maintain complete control over their funds and private keys throughout the trading process. The DEX never takes custody of your assets, significantly reducing the risk of a centralized hack or seizure.

- Smart Contracts: DEXs rely on self-executing code called smart contracts to automate and govern the trading, settlement, and record-keeping processes directly on the blockchain. This makes the transactions trustless, meaning you don’t have to trust a company to be honest.

- Liquidity Pools (AMM): The most popular type of DEX uses an Automated Market Maker (AMM) system. The users deposit pairs of tokens into “liquidity pools” (smart contracts). Trades are then executed against this pool, with the price set algorithmically, instead of matching individual buyer and seller orders.

It has three types, i.e., AMMS, Order Book, and DEX aggregators. Let’s talk about them and how they work.

3 Types of Decentralized Exchanges and Their Examples

| Type of DEX | How It Works | Examples |

|---|---|---|

| Automated Market Makers (AMMs) | Use liquidity pools instead of traditional order books. Users deposit funds into these pools and earn a share of trading fees. | Uniswap, PancakeSwap |

| Order Book DEXs | Record open buy and sell orders and match them like traditional exchanges. Traders set their desired prices. | dYdX, Serum |

| DEX Aggregators | Scan multiple DEXs to find the best prices and lowest transaction fees for users. | 1inch, Matcha |

Now that you know what DEX is and what its types are, let’s talk about how it works.

What Are the Core Decentralized Mechanics behind Crypto’s DEX Exchanges?

Decentralized exchange, as the name suggests, doesn’t have a centralized process. It operates by allowing users to trade cryptocurrencies directly with one another using blockchain-powered smart contracts.

But that’s just a part of the entire system; there are many more parts working together to keep this system working.

Here’s how they work:

Smart Contracts: DEXs use self-executing code (smart contracts) to facilitate trades. When users want to swap cryptocurrencies, they interact directly with a smart contract. These contracts manage the exchange automatically and securely.

Non-custodial Trading: Users retain complete control of their crypto wallets and private keys. Funds are exchanged directly from user wallets, so coins are never held by the DEX platform itself.

Liquidity Pools (AMM Model): The most common form of Decentralized Exchange uses Automated Market Makers (AMMs). In this system, users supply pairs of tokens (liquidity) to pools. Trades are made directly against these pools, and prices are set algorithmically based on the ratio of assets in a pool. They often follow the constant product formula: X×Y=K, which keeps the pool balanced as trades occur.

Order Book Model: Some DEXs use decentralized order books, recording buy and sell orders on-chain and matching trades via smart contracts, though this requires higher blockchain throughput.

Now, while all of this is fine, let’s take an example of a transaction to understand how all of them work, shall we?

When a user wants to swap Token A for Token B:

- They connect their wallet to the DEX.

- The DEX smart contract calculates the price according to the liquidity pool ratios.

- The user approves the transaction, and funds are exchanged between the user’s wallet and the pool.

- Liquidity providers earn fees from every transaction in pools they’ve contributed to.

What are the benefits and risks related to Decentralized Exchange?

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Control & Security | Users retain full custody of their funds through personal wallets, minimizing risks from hacks or exchange bankruptcies. | Users are fully responsible for their private keys; loss of keys means permanent loss of funds. |

| Privacy & Anonymity | No KYC or identity verification required, preserving user privacy. | Lack of KYC may invite regulatory scrutiny or limit accessibility in some regions. |

| Transparency | All transactions occur on-chain and can be publicly audited in real time. | Public data can also expose trading activity, reducing privacy for some users. |

| Censorship Resistance | No central authority to freeze assets or block transactions. | Limited recourse in case of fraud or disputes. |

| Counterparty Risk | Funds are not held by a third party, reducing exposure to theft or mismanagement. | Smart contract vulnerabilities can still lead to asset loss. |

| Fees | Lower operational costs and competitive transaction fees. | Network gas fees can spike during congestion, raising transaction costs. |

| Functionality | Peer-to-peer trading without intermediaries. | Often lacks features like margin trading, lending, or fiat support. |

| Liquidity & Volume | Growing liquidity on major DEXs, with support for many tokens. | Lower overall liquidity can cause price slippage and affect large trades. |

| Efficiency | Operates 24/7 globally without centralized downtime. | On-chain transactions can be slow during high network activity. |

| User Experience | Full autonomy and control appeal to crypto-savvy users. | Interfaces can be complex for beginners, with limited customer support. |

| Regulation | Operates independently from centralized control. | Regulatory uncertainty could lead to restrictions or shutdowns. |

DEX vs CEX: Which is better and how do they differ?

The main difference between Decentralized Exchange and Centralized Exchange (CEX) is the control, custody of assets, and operational structure. In CEX, the exchange controls users’ private keys and funds, whereas DEX lets users retain control of their private keys and funds.

Let’s see some more key differences between the two:

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Control of Funds | Exchange controls users’ private keys and funds | Users retain control of their private keys and funds |

| Custody Model | assets held in exchange wallets | assets stay in users’ wallets |

| User Experience | User-friendly, easy to navigate, supports fiat-to-crypto | More complex, requires wallet knowledge, crypto-to-crypto only |

| Liquidity & Volume | Typically, higher liquidity and trading volume | Generally lower liquidity; may face slippage and volatility |

| Security Risks | Vulnerable to large hacks due to centralized custody | Less prone to large-scale hacks; vulnerable to smart contract bugs and user errors |

| Regulation & Compliance | Heavily regulated, often requires KYC/AML | Mostly unregulated, offering more privacy |

| Fees | Lower trading fees; may charge withdrawal fees | Fees depend on blockchain gas costs; no withdrawal fees |

| Transaction Speed | Fast, near-instant settlement via internal systems | Slower; dependent on blockchain network conditions |

| Privacy | Requires identity verification and personal data | Allows anonymous trading with minimal personal data |

| Customer Support | Provides customer service and dispute resolution | Typically, no customer support; users self-manage |

| Token Availability | Access to vetted and regulated tokens | Access to a wide range of tokens, including new and niche ones |

To summarize it, CEXs act more like traditional brokers or banks with easier use, higher liquidity, and regulatory safeguards, but require trusting a third party with funds. DEXs offer true decentralized and trustless trading, greater privacy, and control. And CEX is very simple, streamlined, whereas DEX comes with more complexity, risk of smart contract bugs, and less liquidity.

3-Step Formula to Confidently Navigate Any Decentralized Exchange Safely

Now that you know almost everything about DEX, let’s understand how you can use these exchange platforms.

Step 1: Set Up and Fund a Web3 Wallet

Select a non-custodial (or “Web3”) wallet that is compatible with the blockchain your chosen DEX runs on (e.g., MetaMask, Trust Wallet, Phantom, Coinbase Wallet). Back up your seed phrase (or recovery phrase) and store it somewhere safe and offline.

Never share it with anyone. You need the native token of the blockchain to pay for transaction fees (known as “gas”).

Step 2: Connect Your Wallet to the Decentralized Exchange

Type the URL directly into your browser or use a trusted bookmark. Always double-check the URL to avoid phishing scams. Click the “Connect Wallet” button, usually found in the top corner of the site. Choose your wallet from the list (e.g., MetaMask).

A prompt will appear in your wallet extension or app asking you to approve the connection. Review and confirm. Your wallet address should then be displayed on the DEX interface.

Step 3: Swap Tokens (Trading)

Now that you have your account set up, you can swap tokens, i.e., trade. For that, navigate to the “Swap” or “Trade” Section. Choose the token you want to swap from (the one in your wallet) and the token you want to swap to (the one you want to receive).

Input the amount of the “swap from” token you wish to trade. The DEX will automatically calculate the estimated amount of the “swap to” token you will receive.

If you are swapping a specific token for the first time on that Decentralized Exchange, you will need to grant permission for the DEX’s smart contract to spend that token on your behalf. This is a separate, small transaction for a gas fee.

But is there anything else you can do, beyond basic crypto trades? Yes! You can become a Liquidity Provider (LP) on an Automated Market Maker (AMM) DEX (like Uniswap or PancakeSwap) to earn a portion of the trading fees.

Here’s what you need to do:

- Navigate to the “Pool” or “Liquidity” Section.

- Select a Pair: Choose a token pair (e.g., ETH/USDC) to provide liquidity for.

- Deposit Equal Value: You must deposit an equal value of both tokens into the pool.

- Receive LP Tokens: In exchange, you will receive Liquidity Pool (LP) tokens, which represent your share of the pool.

- Earn Fees: These LP tokens entitle you to a proportional share of the trading fees generated by that pool.

- Withdraw: To get your initial deposit and earned fees back, you must “remove” your liquidity by burning your LP tokens.

Important Risk Note: Providing liquidity carries the risk of Impermanent Loss.

Now, what is impermanent loss? It is the temporary loss of funds due to price changes in the tokens you deposited, compared to just holding them in your wallet.

Future Trends of Decentralized Exchange to look out for

According to Grandview Research, the global decentralized finance market is projected to grow at a compound annual growth rate (CAGR) of about 53.7% from 2025 to 2030. It is estimated to reach roughly $231.19 billion by 2030.

DEX trading volume is rising sharply each year. The year 2025 saw a ~37% increase and average monthly volumes of around $412 billion. Total value locked (TVL) in DeFi protocols reached $123.6 billion in Q2 2025, up 41% year-over-year.

Uniswap remains a major DEX, processing about 50 to 60% of weekly Decentralized Exchange volume.

Adoption of Layer 2 scaling solutions will reduce transaction costs and increase speed. This has made DEXs more accessible for smaller traders and enhanced user experience. Cross-chain bridges and multi-chain trading features will allow asset trading across different blockchains. This will help in overcoming the current limitations of a single blockchain ecosystem.

More institutional investors and professional traders are entering DEXs. This is due to increasing liquidity, security improvements, and regulatory clarity.

Growth in decentralized perpetual futures, derivatives, liquid staking, and automated market maker (AMM) improvements will expand the available financial tools on Decentralized Exchange platforms.

Conclusion:

The blockchain is the foundation of finance’s future, and the Decentralized Exchange is at its forefront. The journey into this new frontier comes with unique challenges of itself. But the lessons learned from its complexities are invaluable. It’s a space that rewards those who prioritize self-custody and transparency over convenience.

Ultimately, the choice between traditional and decentralized trading comes down to a matter of trust and control. As this ecosystem continues to progress, it’s becoming clear that the Decentralized Exchange isn’t just a momentary trend. It is a fundamental shift towards a more open and user-owned financial system.

FAQs

1. Are my transactions on a DEX truly anonymous?

Your identity isn’t tied to your wallet, but all transactions are public on the blockchain ledger. This means your addresses and trade activity are visible.

2. Is Decentralized Exchange governance truly decentralized with voting tokens?

No, a “decentralization illusion” exists. In DEX, power often concentrates among a few large token holders. Their votes can override smaller community decisions, creating centralization risk.

3. What is a common user mistake when sending tokens?

Accidentally sending tokens to a smart contract address instead of a personal wallet address is a mistake. Those tokens may become permanently stuck and unrecoverable.